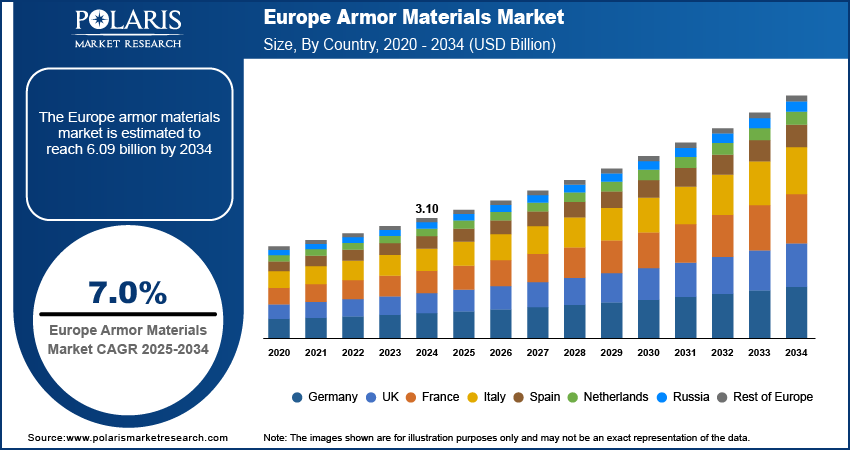

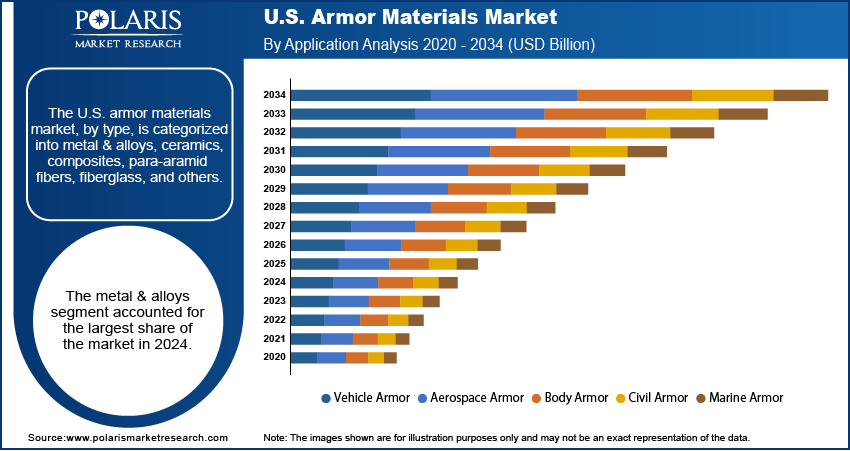

The U.S. armor materials market is valued at USD 4.55 billion in 2024 and is projected to grow at a CAGR of 7.0 % from 2025 to 2034, according to Polaris Market Research. That steady baseline underlines how the U.S. plays a central role in global armor materials demand, but assessing strategic opportunity requires positioning the U.S. in relation to developments in Europe, Asia Pacific, and other regional corridors. In North America more broadly, U.S. demand is bolstered by defense modernization, homeland security investments, law enforcement procurement, and industry-led R&D in materials such as ceramics, composites, and advanced alloys. Canada and Mexico, while smaller in scale, contribute through cross-border supply and defense industrial cooperation, forming a contiguous North American manufacturing zone. The region is also distinguished by strong regulatory norms for certification, high performance expectations, and mature supply chains. In Europe, procurement frameworks (NATO alignments, EU defense cooperation, national budgets) exert outsized influence. European nations often require armor material certification to European ballistic and safety standards, which can differ from U.S. MIL‐STD or NIJ protocols. Thus, U.S. exporters of armor materials must adapt to cross-border compliance, regional manufacturing trends (establishing EU fabrication or finishing plants), and import duties or trade compliance demands. Meanwhile, in Asia Pacific the pace of adoption is fastest, driven by rising defense allocations in China, India, South Korea, and Southeast Asia. Many governments in APAC are pushing for domestic sourcing, local content or offsets, and the establishment of regional composite or ceramic processing hubs to reduce dependency on imports. Those shifts force armor material vendors to rework cross-border supply chains, invest in local assembly or finishing, and tailor market penetration strategies regionally.

Drivers of demand differ in emphasis across these regions. In the U.S., the driver is strong defense budgets, continuous fleet upgrades, and research into lighter, higher-performance solutions (e.g. hybrid ceramics and composite layering). In Europe, drivers include mandates for indigenous defense capacity, emphasis on modular armor systems, and the need to replace aging Cold War era platforms. In Asia Pacific, the driver is sheer growth in procurement alongside geopolitical pressure to localize critical capabilities. Restraints also vary regionally: U.S. and Europe both face high raw material costs, certification complexity, and long technology qualification cycles. Asia Pacific, particularly emerging markets, struggle with inconsistent quality standards, import restrictions, and limited infrastructure for finishing or quality control. Additionally, supply constraints in advanced ceramics, specialty fibers, or rare components (e.g. boron carbide or ultra-high modulus fibers) can bottleneck output globally, and these constraints are felt acutely in import-reliant geographies.

Read More @

https://www.polarismarketresearch.com/industry-analysis/us-armor-materials-market

Opportunities lie in regional manufacturing trends and territorial deployment strategies. U.S.-based material firms can invest in satellite finishing or machining plants in Europe or Asia to mitigate import tariffs and accept regional content mandates. They can also reconfigure cross-border supply chains to ship “semi-finished blanks” to regional hubs rather than complete modules. Market penetration strategies should include licensing, joint ventures, or offset partnerships in strategic defense markets (India, Indonesia, Middle East). Further, bundled solutions (material + design + certification support) offer value to defense integrators reluctant to adopt new materials without performance guarantees. Trends emerging include vertical integration from raw fiber or ceramic precursor production to module-level armor, consolidation by larger materials firms acquiring niche composite or ceramic developers, and the rise of smart or adaptive armor materials (embedded sensors, active stiffening layers) as next-gen differentiation.

Within the U.S. region, material providers must embed stronger logistics, maintain qualification labs, and forge closer integration with defense primes who bundle modules or integrate complete armor systems. In Europe, providers often adopt European finishing, regional certification labs, and local partnerships to satisfy regional procurement mandates.

The U.S. armor materials market is valued at USD 4.55 billion in 2024 and is projected to grow at a CAGR of 7.0 % from 2025 to 2034, according to Polaris Market Research. That steady baseline underlines how the U.S. plays a central role in global armor materials demand, but assessing strategic opportunity requires positioning the U.S. in relation to developments in Europe, Asia Pacific, and other regional corridors. In North America more broadly, U.S. demand is bolstered by defense modernization, homeland security investments, law enforcement procurement, and industry-led R&D in materials such as ceramics, composites, and advanced alloys. Canada and Mexico, while smaller in scale, contribute through cross-border supply and defense industrial cooperation, forming a contiguous North American manufacturing zone. The region is also distinguished by strong regulatory norms for certification, high performance expectations, and mature supply chains. In Europe, procurement frameworks (NATO alignments, EU defense cooperation, national budgets) exert outsized influence. European nations often require armor material certification to European ballistic and safety standards, which can differ from U.S. MIL‐STD or NIJ protocols. Thus, U.S. exporters of armor materials must adapt to cross-border compliance, regional manufacturing trends (establishing EU fabrication or finishing plants), and import duties or trade compliance demands. Meanwhile, in Asia Pacific the pace of adoption is fastest, driven by rising defense allocations in China, India, South Korea, and Southeast Asia. Many governments in APAC are pushing for domestic sourcing, local content or offsets, and the establishment of regional composite or ceramic processing hubs to reduce dependency on imports. Those shifts force armor material vendors to rework cross-border supply chains, invest in local assembly or finishing, and tailor market penetration strategies regionally.

Drivers of demand differ in emphasis across these regions. In the U.S., the driver is strong defense budgets, continuous fleet upgrades, and research into lighter, higher-performance solutions (e.g. hybrid ceramics and composite layering). In Europe, drivers include mandates for indigenous defense capacity, emphasis on modular armor systems, and the need to replace aging Cold War era platforms. In Asia Pacific, the driver is sheer growth in procurement alongside geopolitical pressure to localize critical capabilities. Restraints also vary regionally: U.S. and Europe both face high raw material costs, certification complexity, and long technology qualification cycles. Asia Pacific, particularly emerging markets, struggle with inconsistent quality standards, import restrictions, and limited infrastructure for finishing or quality control. Additionally, supply constraints in advanced ceramics, specialty fibers, or rare components (e.g. boron carbide or ultra-high modulus fibers) can bottleneck output globally, and these constraints are felt acutely in import-reliant geographies.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-armor-materials-market

Opportunities lie in regional manufacturing trends and territorial deployment strategies. U.S.-based material firms can invest in satellite finishing or machining plants in Europe or Asia to mitigate import tariffs and accept regional content mandates. They can also reconfigure cross-border supply chains to ship “semi-finished blanks” to regional hubs rather than complete modules. Market penetration strategies should include licensing, joint ventures, or offset partnerships in strategic defense markets (India, Indonesia, Middle East). Further, bundled solutions (material + design + certification support) offer value to defense integrators reluctant to adopt new materials without performance guarantees. Trends emerging include vertical integration from raw fiber or ceramic precursor production to module-level armor, consolidation by larger materials firms acquiring niche composite or ceramic developers, and the rise of smart or adaptive armor materials (embedded sensors, active stiffening layers) as next-gen differentiation.

Within the U.S. region, material providers must embed stronger logistics, maintain qualification labs, and forge closer integration with defense primes who bundle modules or integrate complete armor systems. In Europe, providers often adopt European finishing, regional certification labs, and local partnerships to satisfy regional procurement mandates.