South Africa Venture Capital Investment Market Size, Growth & Forecast 2025-2033

Market Overview

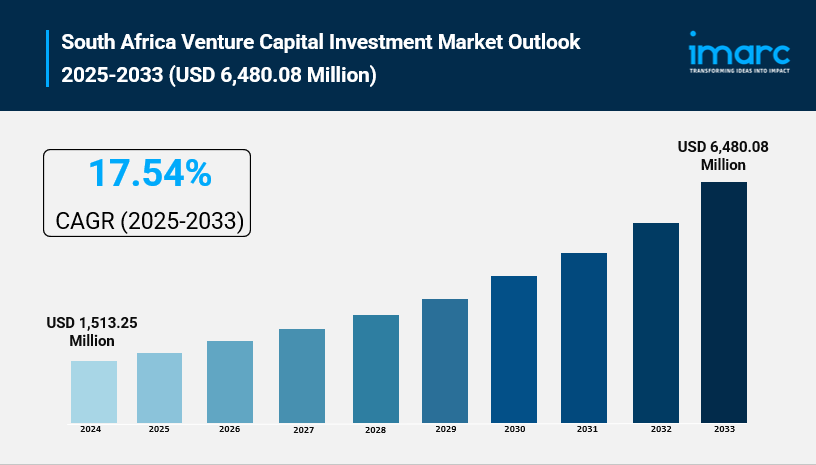

The South Africa venture capital investment market attained a size of USD 1,513.25 Million in 2024. It is projected to expand to USD 6,480.08 Million by 2033, driven by a robust entrepreneurial ecosystem, increasing foreign investment, and government incentives supporting tech startups. The landscape is further fueled by demand for digital solutions, fintech growth, and access to emerging markets. The forecast period spans from 2025 to 2033, with a compound annual growth rate of 17.54%. For more details, refer to the full South Africa Venture Capital Investment Market.

How AI is Reshaping the Future of South Africa Venture Capital Investment Market

- Venture capital investors are increasingly funding startups leveraging artificial intelligence (AI) technologies, such as machine learning and natural language processing, across industries including fintech, healthcare, and agritech.

- Government and private sector initiatives are fostering AI innovation hubs and accelerators in South Africa, enhancing startup capabilities and investor confidence.

- AI-driven analytical tools empower VCs to conduct due diligence, risk assessment, and market prediction more accurately, improving investment decision-making.

- Startups employing AI to develop scalable digital solutions attract significant follow-on venture funding, reflecting increased investor interest in tech-enabled growth.

- The integration of AI with blockchain and fintech platforms is creating novel business models, expanding opportunities for high-return investments within the market.

- Collaborative programs such as the Africa Venture Finance Programme promote knowledge-sharing among African VCs on AI investment strategies, accelerating ecosystem maturity.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-venture-capital-investment-market/requestsample

Market Growth Factors

The expansion of the South Africa venture capital investment market is largely driven by the proliferation of tech startups that capitalize on breakthrough technologies like artificial intelligence, blockchain, and fintech. These startups are revolutionizing traditional sectors and contributing to economic growth through innovation and job creation. The report highlights that increasing internet penetration coupled with a youthful demographic eager to adopt new technologies is turning South Africa into a tech hub. Local and foreign venture capitalists are attracted to this vibrant ecosystem, boosting the market size and creating unprecedented growth opportunities.

Impact investing is becoming a significant trend, where investors seek ventures that generate positive social and environmental outcomes alongside financial returns. Heightened awareness of societal issues such as unemployment, inequality, and environmental sustainability is encouraging venture capitalists to finance startups that address these challenges. Many firms now integrate environmental, social, and governance (ESG) criteria into their operations, supported by local accelerators and incubators. This alignment of profit with social impact not only attracts a new generation of investors but also accelerates the development of startups intending to create meaningful societal value.

Government incentives and increasing foreign investments are further bolstering the South African venture capital market. The government’s support in nurturing a young, innovative workforce and creating a robust entrepreneurial ecosystem motivates private investments. Moreover, the demand for digital solutions and access to emerging markets enhance the attraction for venture capital funding. Collaboration initiatives and programs designed to strengthen the startup landscape improve investor confidence and contribute significantly to the market’s rapid growth.

The market report offers a comprehensive analysis of the segments, highlighting those with the largest South Africa venture capital investment market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Market Segmentation

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

Funding Type Insights:

- First-Time Venture Funding

- Follow-on Venture Funding

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- November 2025: Regulatory sandbox unlocks global capital for startups, enabling faster offshore IP structuring while retaining 100% South African operations and jobs, following a decade of consultations with SARB and SARS.

- November 2025: Open-source VC documentation suite launches to standardize term sheets and reduce legal costs by up to 50%, mirroring UK and US models to accelerate early-stage deal-making.

- December 2025: SME banking platform Zazu secures $1m pre-seed funding, leveraging AI-driven credit scoring to serve 70% unbanked African small businesses across five countries.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness