-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Evènements

-

Reels

-

Blogs

-

Offres

-

Emplois

-

Forums

-

Film

Cryptocurrency Banking Market Innovations, Regulatory Challenges, and Future Trends

"Executive Summary: Cryptocurrency Banking Market Size and Share by Application & Industry

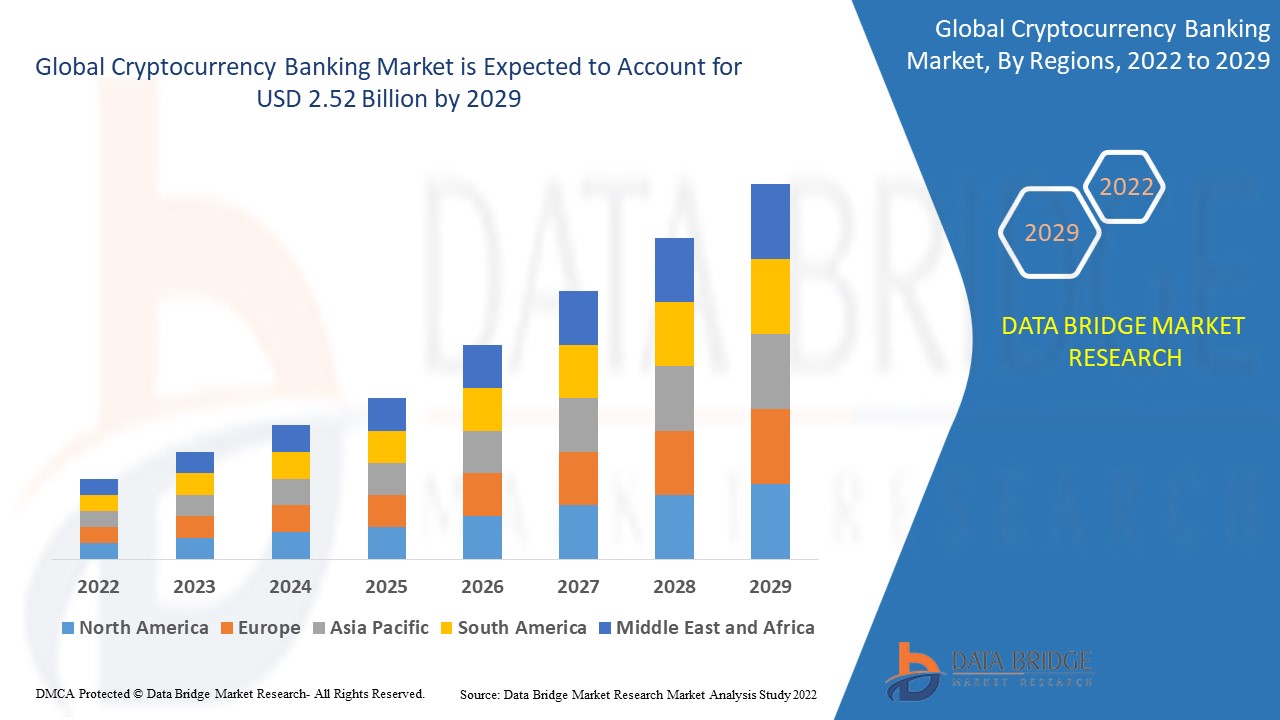

Data Bridge Market Research analyses that the cryptocurrency banking market was valued at USD 1.49 billion in 2021 and is expected to reach the value of USD 2.52 billion by 2029, at a CAGR of 6.80% during the forecast period.

The leading Cryptocurrency Banking Market analysis report is a careful investigation of current scenario of the market and future estimations which spans several market dynamics. This market report presents the best market and business solutions to Cryptocurrency Banking Market industry in this rapidly revolutionizing market place to thrive in the market. Market definition gives the scope of particular product with respect to the driving factors and restraints in the market. Competitor strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions can be utilized well by the Cryptocurrency Banking Market industry to take better steps for selling goods and services.

Market share analysis and key trend analysis are the key accomplishing factors in Cryptocurrency Banking Market document. DBMR team provides this market research report with commitment that is promising and the way in which anticipated. This helps to recognize how the market is going to perform in the forecast years by giving information about market definition, classifications, applications, and engagements. Moreover, this global market report puts light on various strategies that are used by key players of the market. By thinking from the customer’s perspective, a team of researchers, forecasters, analysts and industry experts work carefully to formulate Cryptocurrency Banking Market analysis report.

Discover how the Cryptocurrency Banking Market is changing with key trends and forecasts. Access the report:

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market

Comprehensive Overview of the Cryptocurrency Banking Market

**Segments**

- By Type: On-Premise, Cloud-Based

- By Application: Personal Use, Large Enterprises, SMEs

- By Geography: North America, Europe, Asia-Pacific, South America, Middle East and Africa

The global cryptocurrency banking market is segmented based on type, application, and geography. In terms of type, the market can be divided into on-premise and cloud-based solutions. On-premise solutions involve hosting the banking infrastructure within the premises of the organization, providing more control over data but requiring higher maintenance costs. On the other hand, cloud-based solutions offer scalability and cost-effectiveness but at the expense of potential security concerns. When it comes to the application, cryptocurrency banking services cater to personal use, large enterprises, and small to medium-sized enterprises (SMEs). Personal users employ cryptocurrency banking for investments and transactions, while large enterprises and SMEs may utilize these services for various financial operations. Geographically, the market can be analyzed across regions such as North America, Europe, Asia-Pacific, South America, and the Middle East and Africa, each presenting unique opportunities and challenges for cryptocurrency banking providers.

**Market Players**

- Coinbase

- Revolut

- Bitwala

- Alipay

- Challenger

- Cashaa

- Leap

- Galaxy Digital

- J.P. Morgan Chase & Co.

- Kaiserex

The global cryptocurrency banking market boasts a diverse range of players offering a multitude of services in the digital finance space. Companies like Coinbase, Revolut, and Bitwala have gained popularity for their user-friendly platforms that enable seamless transactions and investments in cryptocurrencies. Traditional financial institutions such as J.P. Morgan Chase & Co. are also entering the cryptocurrency banking arena to meet the evolving needs of their customers. Challenger brands like Cashaa and Leap are disrupting the financial sector with innovative solutions that bridge the gap between traditional banking and digital assets. Moreover, Alipay, a prominent player in the digital payment industry, has started integrating cryptocurrency services into its platform, signaling a shift towards mainstream adoption. Established investment firms like Galaxy Digital and emerging platforms like Kaiserex are also contributing to the growth of the cryptocurrency banking market by providing diverse investment opportunities and financial products to meet the demands of investors worldwide.

The global cryptocurrency banking market is witnessing a paradigm shift with the emergence of innovative technologies and a growing demand for digital financial solutions. One of the key trends shaping the market is the increasing adoption of blockchain technology to enhance security and transparency in cryptocurrency transactions. By leveraging the decentralized nature of blockchain, cryptocurrency banking providers can offer secure and tamper-proof financial services to users across the globe. Additionally, the integration of artificial intelligence and machine learning algorithms in cryptocurrency banking platforms is enabling more personalized and efficient services, driving customer engagement and loyalty.

Another significant trend in the cryptocurrency banking market is the rise of decentralized finance (DeFi) solutions that are revolutionizing traditional banking processes. DeFi platforms leverage blockchain technology to offer decentralized lending, borrowing, and trading services without the need for intermediaries, providing users with greater control over their assets and financial decisions. This trend is reshaping the financial landscape by enabling peer-to-peer transactions and fostering financial inclusion for individuals and businesses globally.

Moreover, regulatory developments are playing a crucial role in shaping the cryptocurrency banking market landscape. As governments and regulatory bodies around the world seek to establish clear guidelines and frameworks for the operation of cryptocurrency banking services, market players are adapting their business models to ensure compliance and build trust among users. Regulatory clarity is essential for fostering investor confidence and driving mainstream adoption of cryptocurrencies and digital assets in the banking sector.

Furthermore, the increasing collaboration between traditional financial institutions and cryptocurrency banking providers is blurring the lines between conventional and digital finance. Partnerships and strategic alliances between banks, fintech companies, and cryptocurrency platforms are enabling the seamless integration of digital assets into traditional banking services, opening up new revenue streams and business opportunities for market players. This convergence of traditional and digital finance is driving innovation and expanding the scope of cryptocurrency banking offerings to cater to a diverse range of consumer needs and preferences.

In conclusion, the global cryptocurrency banking market is undergoing rapid transformation driven by technological advancements, regulatory developments, and evolving consumer preferences. As market players continue to innovate and collaborate to meet the growing demand for digital financial services, the landscape of cryptocurrency banking is poised for further growth and diversification. By embracing emerging technologies, regulatory frameworks, and strategic partnerships, cryptocurrency banking providers can position themselves for long-term success in an increasingly digital and interconnected financial ecosystem.The global cryptocurrency banking market is experiencing a significant transformation driven by a convergence of innovative technologies, evolving consumer preferences, and regulatory developments. One of the key drivers impacting the market is the increasing adoption of blockchain technology to enhance security and transparency in cryptocurrency transactions. Blockchain's decentralized nature provides a secure and tamper-proof framework for conducting financial transactions, instilling trust among users and reducing the risk of fraud or manipulation.

Moreover, the integration of artificial intelligence and machine learning algorithms in cryptocurrency banking platforms is revolutionizing the way financial services are delivered. These technologies enable personalized services, efficient customer interactions, and predictive analytics to cater to the evolving needs of cryptocurrency users. By leveraging AI-powered solutions, cryptocurrency banking providers can enhance customer engagement, streamline operations, and drive business growth in a competitive market landscape.

Another significant trend shaping the cryptocurrency banking market is the emergence of decentralized finance (DeFi) solutions. DeFi platforms leverage blockchain technology to offer decentralized financial services such as lending, borrowing, and trading without the need for traditional intermediaries. This trend is democratizing access to financial services, empowering users to have greater control over their assets, and fostering financial inclusion for individuals and businesses worldwide. The rise of DeFi is reshaping traditional banking processes and paving the way for a more accessible and transparent financial ecosystem.

Furthermore, regulatory developments play a crucial role in influencing the growth and adoption of cryptocurrency banking services. As governments and regulatory bodies around the world strive to establish clear guidelines and frameworks for the operation of digital assets, market players are navigating compliance challenges and building trust among users. Regulatory clarity is essential for fostering investor confidence, ensuring consumer protection, and promoting the mainstream adoption of cryptocurrencies in the banking sector. Adapting to evolving regulatory requirements will be vital for cryptocurrency banking providers to sustain long-term growth and credibility in the market.

In conclusion, the global cryptocurrency banking market is evolving rapidly, driven by technological innovations, changing consumer behaviors, and regulatory dynamics. Market players that embrace blockchain technology, artificial intelligence, DeFi solutions, and regulatory compliance will be well-positioned to capitalize on the growing demand for digital financial services. Collaborations, strategic partnerships, and continuous innovation will be key strategies for cryptocurrency banking providers to navigate the complexities of the market, differentiate their offerings, and capture new opportunities in the dynamic landscape of digital finance.

Assess the business share occupied by the company

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market/companies

Analyst-Focused Question Templates for Cryptocurrency Banking Market Evaluation

- What is the current global valuation of the Cryptocurrency Banking Market?

- What compound annual growth rate is expected through the forecast years?

- How is the Cryptocurrency Banking Market segmented by product, application, or region?

- Which companies hold leading positions in the Cryptocurrency Banking Market landscape?

- What recent product innovations or strategic moves have impacted the Cryptocurrency Banking Market ?

- Which countries are included in the geographical analysis of the Cryptocurrency Banking Market ?

- Which regional market is expanding at the most rapid pace?

- Which nation is projected to capture the largest Cryptocurrency Banking Market share going forward?

- What geographic region currently dominates the Cryptocurrency Banking Market?

- Which country is forecast to record the highest CAGR during the analysis period?

Browse More Reports:

Global Artificial Knee Joint Market

New Zealand Abrasives Market

Global Almond Extracts Market

Global Auto Catalyst Market

North America Ceramic Membranes Market

Asia-Pacific Gas Cylinder Market

Global Cyber Security in Healthcare Market

Middle East and Africa Terminal Management System (TMS) Market

Global High-Resolution 3D X-Ray Microscopy Market

Global Trim Tabs Market

Global Polyurethane Market

Global Business Intelligence Market

Europe Tokenization Market

Global Two Terminal Zener Diode Market

Global Granuloma Inguinale Market

Global Beauty Facial Mask Market

Global Thin and Ultra-Thin Films Market

Global Retractable Needle Safety Syringes Market

Global Liquid Feed Supplements for Ruminants Market

Global Schottky Diode Market

Global Meloxicam Market

North America Abrasives Market

Global Aquarium Lighting Market

Global Magnetic Particle Imaging Market

Global Terminal Management System (TMS) Market

Global Clip Band Market

Global Maltitol in Chocolate Market

Middle East and Africa Industrial Hoses Market

Global Coastal Patrol Military Vessels Market

Global Sports Supplements Market

Middle East and Africa Terminal Management System (TMS) Market

Asia Pacific Amaranth Oil Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience, which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness