Simplify Your Debt: Know About Debt Consolidation & How It Works

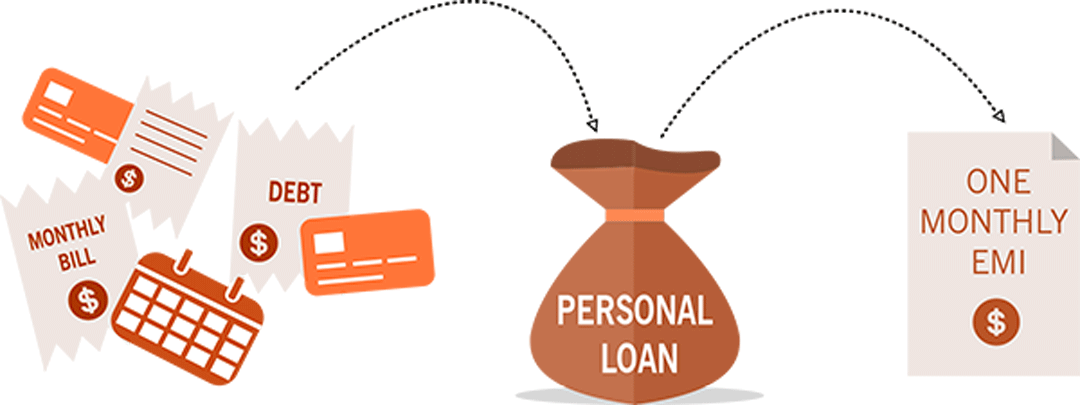

If you’re juggling multiple debts, credit cards, personal loans, or medical bills, debt consolidation might be the solution you need. Simply put, debt consolidation means combining multiple debts into one manageable loan. Instead of making several payments each month, you make just one, usually with a lower interest rate.

Debt Consolidation: How Does It Work?

So, how does debt consolidation work in real life? Here's a simple breakdown:

When you apply for a loan for debt consolidation, you borrow enough money to pay off all your existing debts. Once approved, you use that money to settle those debts and are left with only one loan to repay.

This loan typically comes with better terms, lower interest, fixed monthly payments, and a clear repayment schedule. It simplifies your finances and helps you focus on just one payment.

Types of Loans for Debt Consolidation

There are different options available depending on your credit score, income, and debt amount:

-

Personal Loans – These are unsecured loans you can use to pay off debts. They often have fixed interest rates and are easy to manage.

-

Balance Transfer Credit Cards – If your credit is good, you might qualify for a 0% interest balance transfer card. Transfer your debts to this card and pay them off during the promotional period.

-

Home Equity Loans or HELOCs – If you own a home, you can use its equity to consolidate debts. However, your home is collateral, so there’s more risk.

-

Debt Management Plans – Offered by credit counseling agencies, these plans help you negotiate lower interest rates and consolidate payments without taking out a new loan.

How Does Debt Consolidation Work in Your Favor?

Consolidating your debt can offer several benefits:

-

Lower Interest Rates – Save money over time.

-

One Monthly Payment – Easier to manage your budget.

-

Faster Debt Payoff – With better terms, you may clear your debt sooner.

-

Improved Credit Score – As you pay off your debts and reduce your credit utilization, your score can improve.

Is Debt Consolidation Right for You?

Debt consolidation isn’t a magic fix. It works best if:

-

You have multiple high-interest debts.

-

You can qualify for a lower-interest loan.

-

You’re committed to not accumulating new debt.

Final Thoughts

Understanding how debt consolidation works is the first step to taking control of your financial future. If used wisely, it can reduce stress, simplify your payments, and save you money. Always compare your options and read the terms carefully before choosing the best loans for debt consolidation.

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness