-

Nieuws Feed

- EXPLORE

-

Pagina

-

Groepen

-

Events

-

Reels

-

Blogs

-

Offers

-

Jobs

-

Forums

-

Music Video

Advancing Therapeutic Options Improve Patient Management

"Key Drivers Impacting Executive Summary Cryptocurrency Banking Market Size and Share

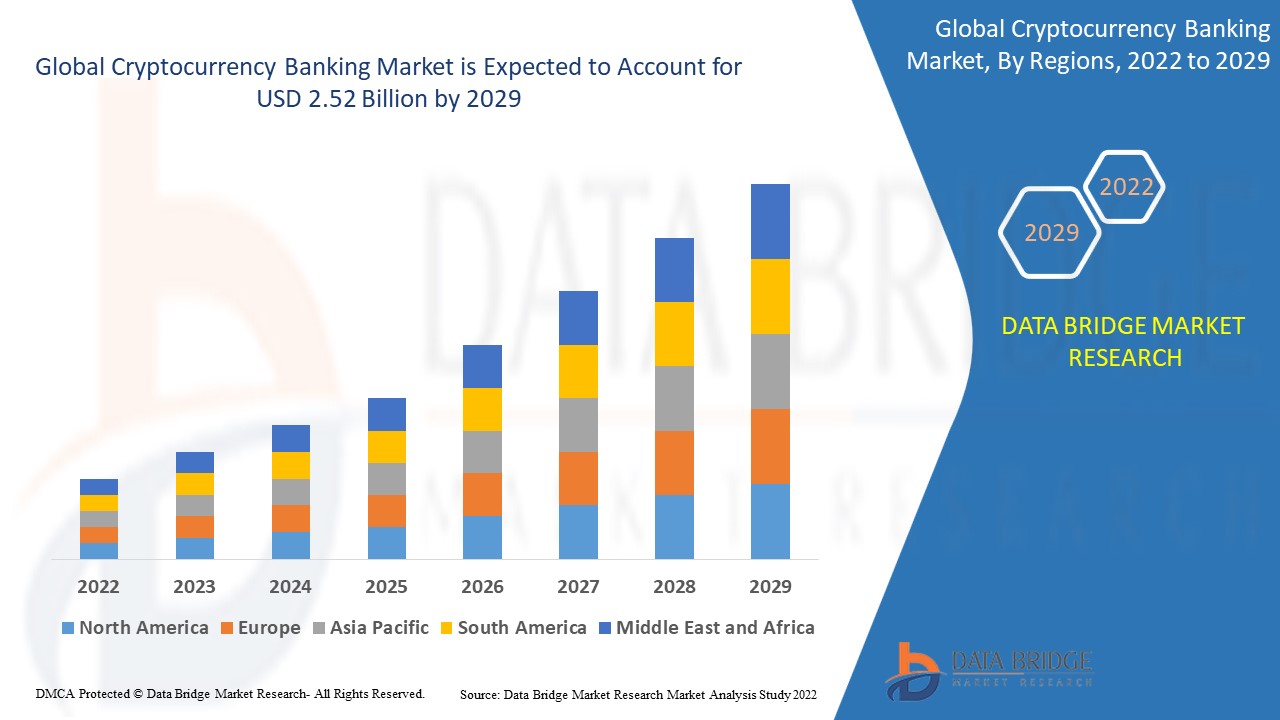

Data Bridge Market Research analyses that the cryptocurrency banking market was valued at USD 1.49 billion in 2021 and is expected to reach the value of USD 2.52 billion by 2029, at a CAGR of 6.80% during the forecast period.

The credible Cryptocurrency Banking Marketreport comprises of various segments linked to Cryptocurrency Banking Market industry and market with comprehensive research and analysis. Market research analysis and insights covered in this report are very considerate for the businesses to make better decisions, to develop better strategies about production, Market, sales and promotion of a particular product and thereby extending their reach towards the success. Businesses can achieve unrivalled insights and acquaintance of the best market opportunities into their respective markets with the help of Cryptocurrency Banking Market analysis report. The market report estimates the growth rate and the market value based on market dynamics and growth inducing factors.

With the specific base year and the historic year, estimations and calculations are performed in the steadfast Cryptocurrency Banking Market This global market report is generated based on the market type, size of the organization, availability on-premises and the end-users’ organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa. The report focuses on major driving factors of the market and the market restraints which generally causes inhibition. An all-inclusive Cryptocurrency Banking Market report conducts the market overview with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players.

Understand market developments, risks, and growth potential in our Cryptocurrency Banking Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market

Cryptocurrency Banking Industry Trends

Segments

- Based on Offering Type: Hardware Wallets, Software Wallets, and Services.

- Based on End-User: Personal Use and Institutional Use.

- Based on Region: North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

The global cryptocurrency banking market is segmented on the basis of offering type, end-user, and region. In terms of offering type, the market is categorized into hardware wallets, software wallets, and services. Hardware wallets are physical devices that securely store private keys offline, making them less susceptible to hacking. Software wallets are applications or programs that store private keys on a computer or mobile device. Services include exchanges, payment processors, and other platforms that facilitate cryptocurrency transactions. When it comes to end-users, the market is divided into personal use and institutional use. Personal use refers to individuals using cryptocurrencies for investment or transactions, while institutional use involves businesses, financial institutions, and other organizations leveraging cryptocurrencies for various purposes. Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

Market Players

- Coinbase.

- ItBit.

- Circle Internet Financial Limited.

- BitPay, Inc.

- Safello Group.

- Xapo.

- Unocoin.

- Bitstamp Ltd.

- ANX INTERNATIONAL.

- Cryptopay.

- CEX.IO LTD.

- Wirex.

- Eobot Inc.

- Bitfinex.

- Ledger SAS.

- Xapo.

- First Virtual Bank of Bitcoin.

The global cryptocurrency banking market is characterized by the presence of several key players who are actively involved in the development and implementation of cryptocurrency banking solutions. Some of the prominent market players in this industry include Coinbase, ItBit, Circle Internet Financial Limited, BitPay, Inc., Safello Group, Xapo, Unocoin, Bitstamp Ltd, ANX INTERNATIONAL, Cryptopay, CEX.IO LTD, Wirex, Eobot Inc, Bitfinex, Ledger SAS, Xapo, and First Virtual Bank of Bitcoin. These players are focusing on strategic partnerships, technological advancements, and geographical expansions to strengthen their market position and cater to the growing demand for cryptocurrency banking services.

The global cryptocurrency banking market is experiencing significant growth and evolution as digital currencies continue to gain acceptance and adoption worldwide. With the increasing popularity of cryptocurrencies like Bitcoin and Ethereum, the demand for cryptocurrency banking services is on the rise. Offering types such as hardware wallets, software wallets, and services play a crucial role in providing secure storage and transaction solutions for individuals and institutions participating in the cryptocurrency space. Hardware wallets offer a high level of security by keeping private keys offline, while software wallets provide convenient access to digital assets through desktop or mobile applications. Additionally, services like exchanges and payment processors facilitate the buying, selling, and transfer of cryptocurrencies, contributing to the overall ecosystem of cryptocurrency banking.

When examining the end-user segmentation of the market, personal use and institutional use represent two key segments with distinct needs and requirements. Personal use involves individuals engaging in cryptocurrency activities for investment purposes or everyday transactions, reflecting the growing trend of retail investors entering the digital asset space. On the other hand, institutional use targets businesses, financial institutions, and organizations looking to leverage cryptocurrencies for various business applications, such as remittances, cross-border payments, and asset management. The differentiation between personal and institutional use highlights the diverse range of stakeholders driving the demand for cryptocurrency banking services and solutions.

From a regional perspective, the global cryptocurrency banking market is geographically dispersed across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region exhibits unique characteristics and market dynamics that influence the adoption and growth of cryptocurrency banking services. North America, particularly the United States, remains a key hub for cryptocurrency innovation and investment, with a high concentration of blockchain startups and digital asset exchanges. Europe and Asia-Pacific are also significant regions for cryptocurrency banking, with countries like the United Kingdom, Switzerland, Japan, and Singapore emerging as prominent cryptocurrency-friendly jurisdictions. South America and the Middle East & Africa are witnessing increasing interest in cryptocurrency adoption, driven by factors like financial inclusion, economic instability, and the need for alternative payment solutions.

In conclusion, the global cryptocurrency banking market is poised for continued expansion and diversification as digital currencies become more mainstream and integrated into the traditional financial system. With a wide range of offerings, end-user segments, and regional opportunities, market players need to adapt to changing trends and customer preferences to stay competitive in the evolving landscape of cryptocurrency banking. By focusing on innovation, security, and market expansion, cryptocurrency banking providers can capitalize on the growing demand for digital asset services and contribute to the ongoing transformation of the financial industry.The global cryptocurrency banking market is witnessing a transformative shift driven by the increasing acceptance and adoption of digital currencies like Bitcoin and Ethereum. As hardware wallets, software wallets, and services play critical roles in ensuring secure storage and seamless transactions for individuals and institutions in the cryptocurrency space, market players are focusing on enhancing their offerings to meet the evolving demands of users. Hardware wallets provide robust security features by keeping private keys offline, while software wallets offer convenient access through desktop or mobile applications. Services such as exchanges and payment processors play a vital role in facilitating the buying, selling, and transferring of cryptocurrencies, contributing to the overall growth of the cryptocurrency banking ecosystem.

In terms of end-user segmentation, the distinction between personal use and institutional use underscores the diverse needs within the cryptocurrency banking market. Personal users engage in cryptocurrency activities for investment and transactional purposes, reflecting the rising trend of retail investors entering the digital asset space. Conversely, institutional users encompass businesses, financial institutions, and organizations seeking to leverage cryptocurrencies for various applications such as remittances, cross-border payments, and asset management. The differentiation between these two segments highlights the breadth of stakeholders contributing to the demand for cryptocurrency banking services and underscores the importance of tailored solutions to cater to their specific requirements.

Geographically, the global cryptocurrency banking market is spread across key regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, each presenting unique opportunities and challenges for market players. North America, particularly the United States, remains a leading hub for cryptocurrency innovation and investment, with a robust ecosystem of blockchain startups and digital asset exchanges driving market growth. Europe and Asia-Pacific also play significant roles in cryptocurrency banking, with countries like the United Kingdom, Switzerland, Japan, and Singapore emerging as key jurisdictions for digital asset adoption. South America and the Middle East & Africa are experiencing growing interest in cryptocurrencies, fueled by factors such as financial inclusion, economic volatility, and the need for alternative payment solutions.

In conclusion, the global cryptocurrency banking market is poised for sustained expansion fueled by the mainstream integration of digital currencies into the traditional financial system. Market players must prioritize innovation, security, and market expansion to stay competitive in this rapidly evolving landscape. By understanding the diverse needs of personal and institutional users, tapping into regional opportunities, and embracing technological advancements, cryptocurrency banking providers can capitalize on the increasing demand for digital asset services and shape the future of the financial industry.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market/companies

Cryptocurrency Banking Market Reporting Toolkit: Custom Question Bunches

- What’s the present market valuation for the Cryptocurrency Banking Market sector?

- What is the estimated yearly growth outlook?

- What segment types are elaborated in the study?

- Who are the main stakeholders in the Cryptocurrency Banking Market?

- What are the newest innovations introduced by companies?

- What regional data points are considered?

- What region shows rapid development?

- Which nation is forecasted to lead the Cryptocurrency Banking Market industry?

- What region dominates in Cryptocurrency Banking Market revenue?

- Which country is experiencing the steepest Cryptocurrency Banking Market growth curve?

Browse More Reports:

Middle East and Africa Wearable Electronic Devices Market

Global Accelerometer Sensor Market

Global Acute Ischemic Stroke Diagnosis and Treatment Market

Global Agricultural Soil Stabilization Market

Global Algae Snacks Market

Global Alpaca Apparel Market

Global Alpha-Amylase Baking Enzyme Market

Global Anesthesia Delivery Units Market

Global Animal Feed Organic Trace Minerals Market

Global Anxiety Disorder Market

Global Auto Catalyst Market

Global Automotive Engine Oil Market

Global Beard Grooming Products Market

Global Beauty Facial Mask Market

Global Belimumab Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness