How Business Risk and Credit Reports Improve Lending and Investment Decisions

In today’s fast-paced business environment, lenders and investors are constantly seeking reliable data to make informed decisions. Enter Business Risk Reports and Business Credit Reports — two critical tools that provide insights into a company’s financial health, operational stability, and potential vulnerabilities. When combined with a Business Information Report, these tools offer a comprehensive overview, enabling smarter lending, investing, and strategic planning.

Understanding Business Risk and Credit Reports

Business Risk Report (BRR)

A Business Risk Report evaluates potential threats that could affect a company’s performance. It focuses on financial, operational, legal, and market risks, helping stakeholders anticipate challenges and make proactive decisions. Key components include:

-

Financial Risks: Debt exposure, cash flow issues, and solvency concerns.

-

Operational Risks: Supply chain vulnerabilities, workforce efficiency, and process gaps.

-

Legal and Compliance Risks: Pending litigations, regulatory compliance, and penalties.

-

Market Risks: Industry volatility, competition, and external threats.

Business Credit Report (BCR)

A Business Credit Report provides detailed information about a company’s creditworthiness and repayment history. Essential elements include:

-

Credit scores and ratings

-

Outstanding loans and liabilities

-

Payment history and defaults

-

Public filings such as bankruptcies or liens

-

Financial ratios and trends

Business Information Report (BIR)

While BRRs and BCRs focus on risk and financial reliability, a Business Information Report provides an overview of the company’s operations, management, and market presence. It complements the other reports, providing a holistic view.

How These Reports Aid Lenders

1. Assessing Creditworthiness

Lenders rely on a combination of Business Credit Reports and Business Risk Reports to evaluate whether a company can meet its financial obligations. By analyzing payment history, debt levels, and operational stability, lenders can decide appropriate credit limits, interest rates, and repayment terms.

2. Mitigating Financial Risk

Risk reports help lenders identify potential vulnerabilities, such as overdue payments, pending litigations, or market instability. This insight allows banks to structure loans with safeguards, minimizing the risk of default.

3. Facilitating Strategic Lending Decisions

By integrating information from all three reports, lenders gain a complete picture of the company’s operational, financial, and risk profile. This enables smarter decisions on loan approvals, credit extensions, and investment portfolios.

How These Reports Assist Investors

1. Informed Investment Decisions

Investors rely on verified financial data to evaluate the potential returns and risks associated with investing in a company. Business Risk Reports highlight vulnerabilities, while Business Credit Reports confirm financial reliability, providing investors with confidence before committing capital.

2. Risk Mitigation

By analyzing risk and credit data, investors can avoid companies with high default probability or operational instability. This minimizes exposure and protects their investment portfolios.

3. Due Diligence

Comprehensive reports help investors conduct thorough due diligence before mergers, acquisitions, or strategic partnerships. Verified data reduces uncertainties and strengthens the basis for investment decisions.

The Synergy of Business Reports

Using Business Information Reports, Business Risk Reports, and Business Credit Reports together creates a 360-degree perspective:

-

Operational Insight: Understand the company’s structure, workforce, and market position.

-

Risk Analysis: Identify threats that could compromise financial performance or growth.

-

Financial Reliability: Evaluate payment history, debts, and overall creditworthiness.

This synergy empowers lenders and investors to make evidence-based decisions with confidence, reducing exposure to financial surprises and enhancing long-term profitability.

Practical Applications

-

Banks and Financial Institutions: Assess loan applications, set credit terms, and manage risk exposure.

-

Private Equity Investors: Evaluate investment opportunities and identify potential red flags.

-

Venture Capitalists: Conduct due diligence for startups and early-stage companies.

-

Corporate Partnerships: Ensure financial stability before entering contracts or joint ventures.

-

Insurance Companies: Determine risk-based premiums and underwriting decisions.

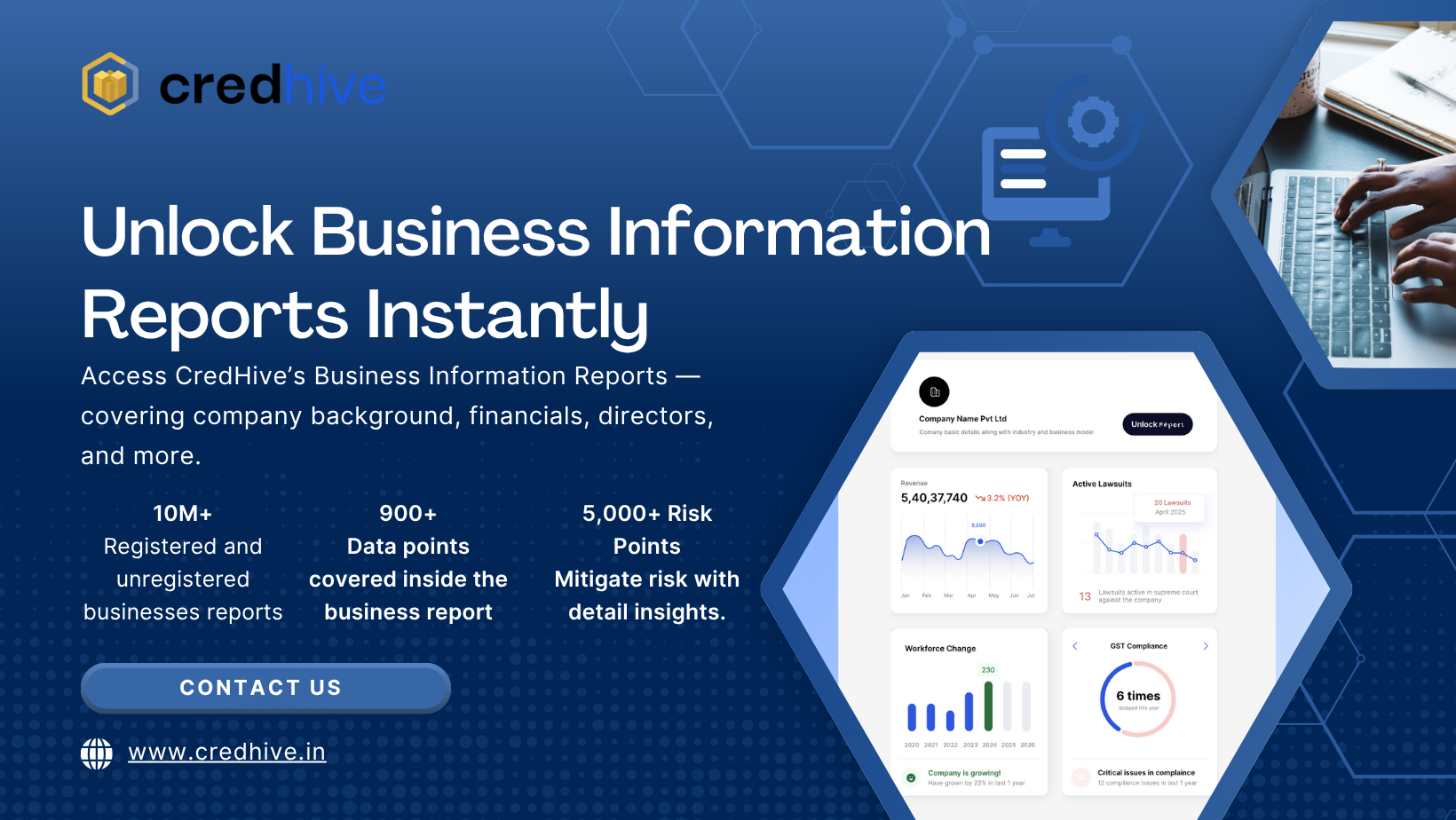

Credhive: Simplifying Risk and Credit Assessment

Credhive provides businesses, lenders, and investors with reliable access to Business Risk Reports, Business Credit Reports, and Business Information Reports. By aggregating verified data from multiple sources, Credhive enables users to:

-

Quickly Find Indian Business Information and Search Company Information.

-

Evaluate creditworthiness and risk profiles efficiently.

-

Generate actionable reports for lending, investing, and strategic decision-making.

-

Reduce time and resources spent on due diligence while enhancing accuracy.

With Credhive, financial stakeholders can make data-driven decisions that improve trust, reduce risk, and enhance returns.

Benefits of Using Business Risk and Credit Reports in Financial Decisions

-

Data-Driven Lending: Lenders can make informed credit decisions based on verified financial and operational data.

-

Reduced Investment Risk: Investors gain insight into potential threats and financial reliability.

-

Improved Trust: Transparent reporting builds confidence among financial stakeholders.

-

Enhanced Portfolio Management: Understanding risk allows for better allocation and diversification.

-

Faster Decision-Making: Access to comprehensive, verified data accelerates lending and investment processes.

Conclusion

In today’s fast-evolving business world, lenders and investors need reliable tools to make informed decisions. Business Risk Reports and Business Credit Reports, combined with Business Information Reports, provide a complete understanding of a company’s financial stability, operational efficiency, and potential threats.

Platforms like Credhive simplify access to these reports, offering verified data that strengthens lending practices, investment decisions, and corporate partnerships. By leveraging these insights, businesses, banks, and investors can reduce risk, enhance transparency, and make smarter, data-backed decisions in B2B markets.

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness