Commercial Telematics Market Size, Share and Trends Forecast 2025-2033

Market Overview:

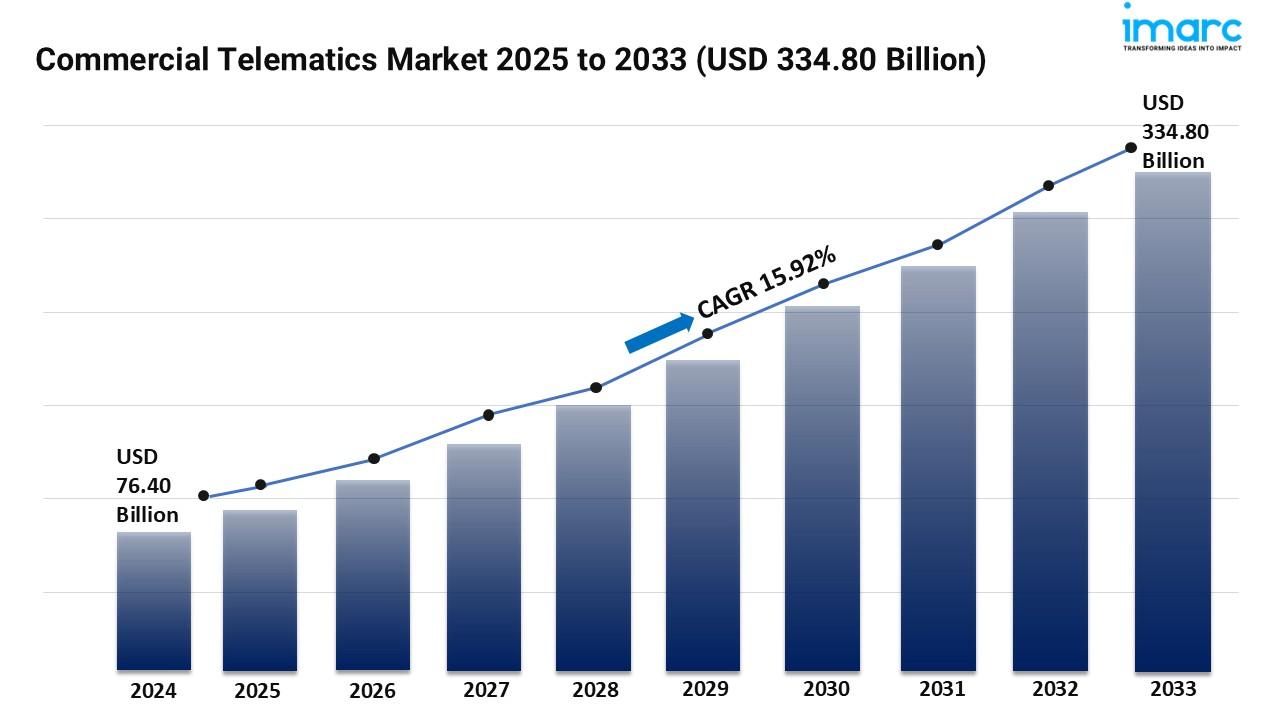

The commercial telematics market is experiencing rapid growth, driven by Increasing Emphasis on Fleet Management, Technological Advancements and Escalating Demand for Real Time Data Analytics. According to IMARC Group's latest research publication, "Commercial Telematics Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033", The global commercial telematics market size was valued at USD 76.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 334.80 Billion by 2033, exhibiting a CAGR of 15.92% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/commercial-telematics-market/requestsample

Our report includes:

-

Market Dynamics

-

Market Trends And Market Outlook

-

Competitive Analysis

-

Industry Segmentation

-

Strategic Recommendations

Growth Factors in the Commercial Telematics Industry:

-

Increasing Emphasis on Fleet Management

The market is largely influenced by the demand for improved efficiency in fleet management. Fleet operators are consistently looking for ways to enhance fuel efficiency, decrease idle times and optimize route planning. Telematics systems provide real-time data analysis that empowers operators to make well-informed decisions leading to reduced operational costs and increased productivity. Moreover, these systems deliver vital information regarding vehicle health which aids in preventive maintenance and cuts down on downtime. According to Geotab, a Canadian technology firm, fleets using telematics can achieve up to a 30% reduction in operational costs with studies indicating that such companies experience fuel savings around 15% and a 25% reduction in vehicle idle time. Furthermore, by offering insights into vehicle health these systems can lower downtime by as much as 20% resulting in additional savings and enhanced productivity. By boosting efficiency telematics also play a role in decreasing carbon footprints supporting sustainability objectives.

-

Technological Advancements

The rapid growth of the Internet of Things and connected technologies has significantly driven the expansion of the commercial telematics sector. Telematics devices leverage IoT to link vehicles with external networks enabling data exchange between vehicles and central systems. This technology allows for the real time monitoring of vehicle location, condition and driver behavior. The incorporation of advanced sensors and machine learning algorithms enhances telematics solutions making them more precise and dependable. These technological improvements have broadened the applications of telematics beyond conventional tracking to include complex analytics for informed decision making. For example, a study predicts that the implementation of telematics solutions featuring integrated machine learning and predictive analytics could boost fleet efficiency by up to 25% and lower operational costs by 15%. These innovations have extended telematics beyond standard tracking by providing sophisticated analytics that aid businesses in making informed decisions.

-

Escalating Demand for Real Time Data Analytics

There is an increasing need for real time data analysis and reporting within the commercial vehicle industry. Telematics solutions offer extensive data regarding vehicle performance, driver conduct and logistics management. For example, the U.S. commercial vehicle sector experienced a 14% rise in registrations in 2023 reaching over 1.6 million vehicles according to an industry report. The ability to evaluate this data instantaneously allows businesses to make quick and informed decisions that can greatly enhance operational efficiency and improve customer satisfaction. This demand for practical insights derived from vehicle data is a significant factor driving the adoption of telematics technology in commercial fleets.

Key Trends in the Commercial Telematics Market:

-

Stringent Regulations

According to the European Commission the EU introduced a regulation in 2020 that mandates the installation of advanced driver assistance systems (ADAS) in all new commercial vehicles promoting telematics integration to monitor driving behavior and improve safety. In the U.S., the Federal Motor Carrier Safety Administration (FMCSA) has mandated the use of electronic logging devices (ELDs) in over 3.4 million commercial trucks to track driving hours and ensure compliance with safety standards. Additionally, regulations in countries like India and China are encouraging telematics adoption to reduce fuel consumption and emissions with the goal of cutting down carbon emissions by 20% in the next decade. These regulations are driving the commercial telematics market leading to increased demand for solutions that enhance safety, optimize fleet management and support sustainability efforts.

-

Growth of Electric and Autonomous Commercial Vehicles

The commercial vehicle industry is no longer dominated solely by traditional diesel-powered trucks and vans. Electric commercial vehicles and autonomous delivery systems are gaining serious traction, particularly in urban logistics and last-mile delivery operations. Telematics systems are essential for managing electric vehicle fleets, providing real-time monitoring of battery health, charge levels, range prediction, and optimal charging schedules. Major logistics companies and retailers are deploying electric delivery vans equipped with advanced telematics that optimize routes based on charging station locations and battery range. Autonomous and semi-autonomous commercial vehicles rely heavily on telematics for navigation, remote monitoring, safety oversight, and fleet coordination. Vehicle manufacturers are partnering with telematics providers to develop integrated solutions specifically designed for electric and autonomous fleet management. Government incentives for electric vehicle adoption and stricter urban emission regulations are accelerating this transition. The specialized telematics requirements of electric and autonomous vehicles are creating new market opportunities and driving innovation in connected vehicle technology.

-

Integration of Artificial Intelligence and Predictive Analytics

Artificial intelligence and machine learning are playing a major role in transforming commercial telematics from simple tracking systems into sophisticated predictive platforms. AI-powered telematics solutions analyze vast amounts of historical and real-time data to predict vehicle maintenance needs before failures occur, significantly reducing unexpected downtime and repair costs. Machine learning algorithms identify patterns in driver behavior, enabling targeted coaching programs that improve safety and reduce accident rates. Predictive analytics help fleet managers optimize routes dynamically based on traffic patterns, weather conditions, delivery schedules, and vehicle performance. Advanced systems can predict fuel consumption patterns and recommend operational changes that maximize efficiency. Computer vision integrated with telematics provides real-time monitoring of driver attention, fatigue, and distraction, triggering immediate alerts when safety risks are detected. By transforming raw telematics data into actionable intelligence and predictive insights, AI integration is substantially increasing the value proposition of commercial telematics solutions and driving adoption across all fleet sizes and industry sectors.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging commercial telematics market trends.

Leading Key Players Operating in the Commercial Telematics Industry:

-

AirIQ Inc.

-

Bridgestone Corporation

-

Continental AG

-

Geotab Inc.

-

GM Envolve

-

MICHELIN Connected Fleet

-

MiX Telematics (Powerfleet, Inc)

-

Octo Telematics S.p.A.

-

Platform Science, Inc.

-

Solera Holdings, LLC

-

Verizon Communications Inc.

Commercial Telematics Market Report Segmentation:

Breakup By Type:

-

Solution

-

Fleet Tracking and Monitoring

-

Driver Management

-

Insurance Telematics

-

Safety and Compliance

-

V2X Solutions

-

Others

-

-

Services

-

Professional services

-

Managed services

-

Solution account for the majority of shares with around 82.8% of the market share in 2024 as it includes hardware and software solutions that constitute the backbone of telematics systems.

Breakup By System Type:

-

Embedded

-

Tethered

-

Smartphone Integrated

Embedded dominates the market due to the integration of telematics hardware and software directly into vehicles during manufacturing, providing continuous and reliable connectivity.

Breakup By Provider Type:

-

OEM

-

Aftermarket

Aftermarket represents the majority of shares with around 69.4% of market share in 2024 due to the versatility of solutions that can be added to existing vehicles and integrated into a broad range of commercial vehicles.

Breakup By End-use Industry:

-

Transportation and Logistics

-

Media and Entertainment

-

Government and Utilities

-

Travel and Tourism

-

Construction

-

Healthcare

-

Others

Transportation and logistics enjoys the leading position with around 32.7% of market share in 2024 owing to the essential requirement for effective fleet management, route optimization and real time monitoring.

Breakup By Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

North America enjoys the leading position with over 37.8% in 2024 owing to developed transportation and logistics sector, strict regulatory standards and an emphasis on enhancing fleet efficiency and safety.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States:+1-201971-6302

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness