AI-Powered Debt Resolution Market, Size, Share, Growth, Trends and Forecast (2025-2033)

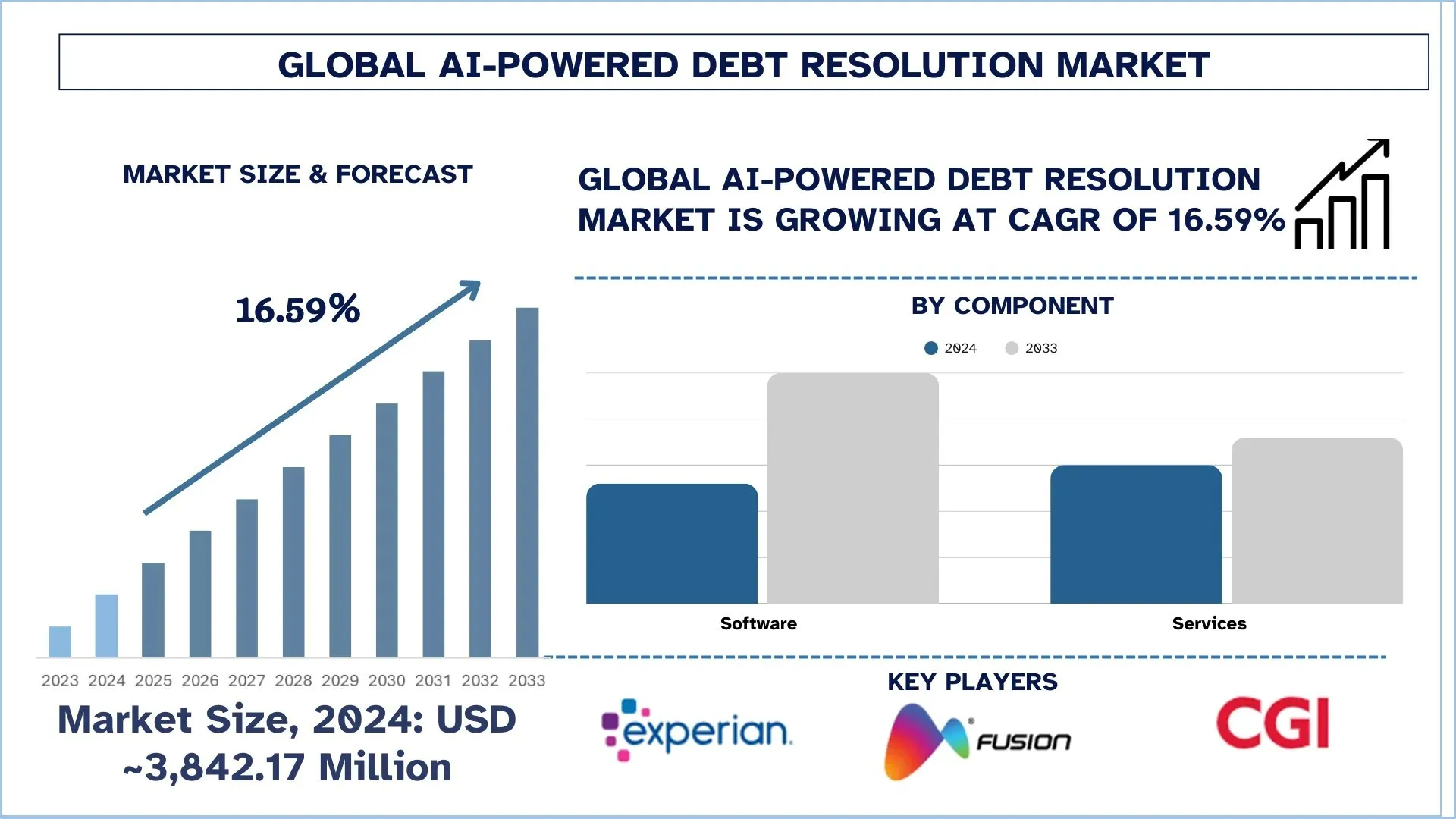

According to the UnivDatos, the rise of the BFSI sector, e-commerce and retail sector, and the rising number of customers availing credit lending facilities, the demand for the AI-powered debt resolution software is further anticipated to grow. As per their “AI-Powered Debt Resolution Market” report, the global Market was valued at USD 3,842.17 million in 2024, growing at a CAGR of about 16.59% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

With the advancement of artificial intelligence, debt resolution has become an intelligent automation tool over the debt collection approach. Implementing technologies such as machine learning, predictive analytics, and natural language processing helps AI solutions to augment human decision-making at the level of the institution for communicating in a personalized manner with debtors and delivering streamlined operations. AI applications can analyze large volumes of data to predict repayment behavior, prioritize high-risk accounts, and propose customized repayment plans. Such technologies help in maximizing recoveries, reducing operational costs, and delivering regulatory compliance.

Rising E-commerce and Retail Sector:

Owing to the rising business volume of eCommerce and retail businesses globally, there is an increase in the volume of transactions and the number of accounts, and consequently, outstanding debts. These are some of the areas where AI-powered debt resolution solutions prove beneficial for these businesses in managing and recovering debts efficiently. Companies can automate the process of communication with customers, offer personalized repayment schedules, and prioritize high-risk accounts with predictive analytics. This improves overall recovery rates.

Access sample report (including graphs, charts, and figures) - https://univdatos.com/reports/ai-powered-debt-resolution-market?popup=report-enquiry

According to the US Department of the Census, the total sales of e-commerce in the US in February of 2025 was USD 722.7 billion, up by 0.2% compared to last month.

In addition to this, as it becomes increasingly complex with the presence of payment behaviors or buying patterns, a growing number of client data in the course of eCommerce, the developed AI systems are able to create easily customized debt solution strategies that enhance customer engagement and customer satisfaction. Indeed, as online retail grows, particularly with the movement towards more and more digital payments, greater dependence on the need for scalable, effective systems for the collection of debts will increasingly be in mind. Such AI-enabled solutions are those that empower e-commerce and retail-based businesses to rescale their debt management processes, lower their operational costs, and maintain optimum customer relations that drive growth in the marketplace.

Latest Trends in the AI-Powered Debt Resolution Market

Personalized Communication:

Personalized communications are the major trend that shapes the driving growth of AI-aided debt collection. The growing demand of people for experiences has impelled collections companies to adopt artificial intelligence for building personalized interaction channels with debtors. AI-powered tools such as bot systems and virtual assistants make use of history to provide personalized reminders for payment, terms negotiated, and disputes handled, all tailored to the debtor's specific situation and behavior.

The NLP and machine learning features enable these systems to glean the tone and context so that conversations can have the appropriate level of empathetic yet effective communication. Using AI to dissect the customers and finally provide them with pertinent, personalized messaging can help debt collection agencies reach out to clients, thereby improving collection.

Its introduction has helped clients by personalizing the communication of frustrations experienced by the debtor and helped financial institutions in recovering debts more efficiently. The more this trend develops, AI becomes the most critical tool in making debt collection customer-friendly while improving both results and relationships.

Integration of Predictive Analytics for Enhanced Debt Recovery Strategies:

The integration of predictive analytics is one of the key trends transforming debt recovery strategies in the AI-enabled debt collection market. As AI models can analyze various contributing factors such as payment history, transaction data, and solvency, estimates can be made about which accounts are likely to settle and which accounts will require a call for much closer follow-up.

Thus, debt collectors can prioritize calls, investing their time and resources in high-value or higher-risk accounts. Predictive analytics can also help to design personalized payment plans and early intervention strategies so that serious delinquency stages might be prevented.

Predictive analytics ensures effective and economical debt collections by improved targeting, better decision-making, and reduced manual intervention. Of course, this trend means higher recovery rates while causing a lower impact on customers, which is really a win-win situation for debtors and creditors.

Regional Market Growth

The North America AI-powered debt resolution market is growing significantly due to the increasing implementation of AI in the financial services industry. North America, especially the United States, is proving to be an early adopter of AI technologies in the domains of debt collection and debt management. The requirement for such advanced debt resolution techniques is fed by the strong financial infrastructure of the region and the high number of financial institutions, banks, and credit agencies in this region.

AI applications in debt recovery measured through predictive analytics, automated communication systems, or machine learning models are being extensively used to facilitate the processes of debt collection and to optimize recovery strategies with reduced operational costs. The debt portfolio is becoming more complex, requiring a more customized approach to a customer-centric solution that brings it within the orbit of AI introduction into debt resolution. Moreover, with strict consumer protection laws in the region, increases in regulatory pressures have motivated the incorporation of AI technologies by financial institutions to comply while being efficient.

Many of the companies operating in North America spend extensively on research and development for sophisticated AI-powered debt resolution platforms custom for different industries like healthcare, telecommunications, and retail. Moreover, the growth of the market complements the increasing tech-savvy population in the region, together with the increasing digitalization of financial services. The region will still be the major contributor to the global AI-enabled debt resolution market as Artificial Intelligence adoption continues to adopt new technologies for innovative future advancements.

Related Parties –

India MSME Payment Risk Management Solution Market

Middle East Buy Now Pay Later Market

Electronic Bill Presentment and Payment Market

Financial Services Application Software Market

Driving Forces Behind AI-Powered Debt Resolution Adoption

The development of the E-Commerce and retail sectors enhances the demand for scalable debt management solutions as businesses deal with increasing volumes of transactions and outstanding dues. Further, personalized communication and predictive analytics are improving customer experience and driving recovery rates. The North American continent is the front-runner, thanks to a strong financial infrastructure and increasing adoption of AI in debt resolution, which is driving innovations and growth in the region.

Additionally, the growth of the BFSI sector, as well as the rise of online debt receiving by customers across the globe, has also proven supportive for market growth.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness