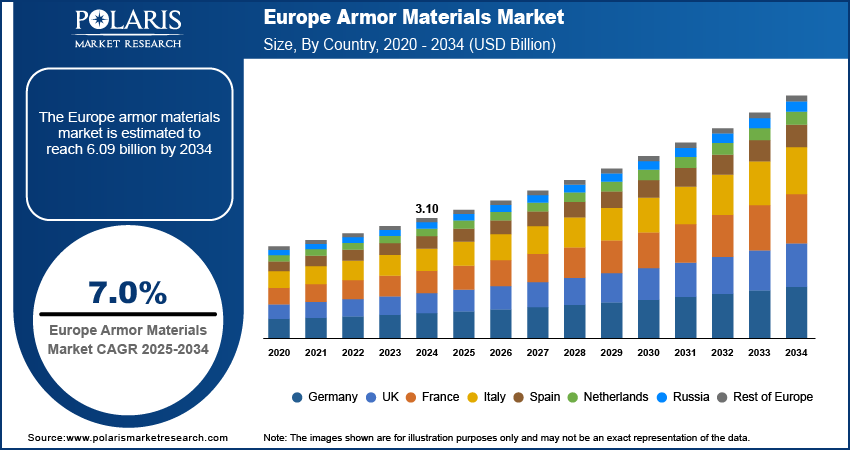

Assuming the Europe armor materials market to be USD 3.10 billion in 2024 with projected 7.0 % CAGR, the segmentation of this market reveals where growth, margin expansion, and risk converge. Dissecting by material type, application domain, end user, and geometry shows how product differentiation, application-specific growth, value chain optimization, and segment-wise performance drive competitive outcomes. In material segmentation, categories include high-hardness and ultra-high hardness steels, ceramics (e.g. alumina, silicon carbide, boron carbide), composites (fiber-reinforced polymers, hybrid laminates), aramid fibers (Kevlar, Twaron), UHMWPE, and sandwich/foam core systems. Within Europe, high-hardness steels such as those from Industeel’s MARS series are established in armored vehicles.But growth is more rapid in ceramics and composites, particularly in aerospace and soldier equipment segments. Composites provide lightweight performance and multifunctional integration (e.g. embedding sensors or ballistic fabrics). In application segmentation, key arenas are vehicle armor (main battle tanks, IFVs, APCs), aerospace and rotorcraft protection, soldier-wear (body armor, helmets), naval or amphibious armor, and civil or critical infrastructure armor (embassy shield walls, armored vehicles for VIP transport). Vehicle armor continues to command the largest share due to scale and volume, but aerospace and soldier-wear segments are fastest growing due to higher performance demands and weight sensitivity.

In end-user segmentation, defense ministries and armed services represent the major buyer base, followed by homeland security, law enforcement, private security contractors, and niche infrastructure deployments. Demand from law enforcement and security often favors modular or add-on protection kits, which are sold into retrofit segments. Geometry and modular segmentation—monolithic plates, tile systems, add-on kits, laminate panels—are fundamental to differentiation. Add-on kit systems allow flexibility and incremental upgrades, making them attractive for retrofit and mixed fleet scenarios. Drivers across these segments include pressure to deliver lighter, stronger materials, demand for modular and upgradable systems, and frequent platform upgrade cycles. Product differentiation is critical—materials that deliver superior multi-hit resistance, lower weight, adaptive layering, or integrated sensors command price premiums. Application-specific growth is highest in aerospace and soldier-wear areas, where each gram matters. In those segments, advanced composites or ceramic backings paired with flexible fabrics are favored.

Value chain optimization is essential: integrating fiber production, ceramic processing, lamination, finishing, and module assembly reduces transition costs, yield losses, and lead time. Suppliers that manage vertical integration—e.g. a firm producing fibers through to finished armor modules—capture more margin. Restraints are significant in many segments: ceramics require precise manufacturing, tight quality control, and high rejection rates; composites must face durability, delamination, and environmental aging; steels lose ground in weight-constrained use cases. Certification cycles are rigorous, and buyers hesitate to adopt new materials without fully validated ballistic performance.

Read More @

https://www.polarismarketresearch.com/industry-analysis/europe-armor-materials-market

Assuming the Europe armor materials market to be USD 3.10 billion in 2024 with projected 7.0 % CAGR, the segmentation of this market reveals where growth, margin expansion, and risk converge. Dissecting by material type, application domain, end user, and geometry shows how product differentiation, application-specific growth, value chain optimization, and segment-wise performance drive competitive outcomes. In material segmentation, categories include high-hardness and ultra-high hardness steels, ceramics (e.g. alumina, silicon carbide, boron carbide), composites (fiber-reinforced polymers, hybrid laminates), aramid fibers (Kevlar, Twaron), UHMWPE, and sandwich/foam core systems. Within Europe, high-hardness steels such as those from Industeel’s MARS series are established in armored vehicles.But growth is more rapid in ceramics and composites, particularly in aerospace and soldier equipment segments. Composites provide lightweight performance and multifunctional integration (e.g. embedding sensors or ballistic fabrics). In application segmentation, key arenas are vehicle armor (main battle tanks, IFVs, APCs), aerospace and rotorcraft protection, soldier-wear (body armor, helmets), naval or amphibious armor, and civil or critical infrastructure armor (embassy shield walls, armored vehicles for VIP transport). Vehicle armor continues to command the largest share due to scale and volume, but aerospace and soldier-wear segments are fastest growing due to higher performance demands and weight sensitivity.

In end-user segmentation, defense ministries and armed services represent the major buyer base, followed by homeland security, law enforcement, private security contractors, and niche infrastructure deployments. Demand from law enforcement and security often favors modular or add-on protection kits, which are sold into retrofit segments. Geometry and modular segmentation—monolithic plates, tile systems, add-on kits, laminate panels—are fundamental to differentiation. Add-on kit systems allow flexibility and incremental upgrades, making them attractive for retrofit and mixed fleet scenarios. Drivers across these segments include pressure to deliver lighter, stronger materials, demand for modular and upgradable systems, and frequent platform upgrade cycles. Product differentiation is critical—materials that deliver superior multi-hit resistance, lower weight, adaptive layering, or integrated sensors command price premiums. Application-specific growth is highest in aerospace and soldier-wear areas, where each gram matters. In those segments, advanced composites or ceramic backings paired with flexible fabrics are favored.

Value chain optimization is essential: integrating fiber production, ceramic processing, lamination, finishing, and module assembly reduces transition costs, yield losses, and lead time. Suppliers that manage vertical integration—e.g. a firm producing fibers through to finished armor modules—capture more margin. Restraints are significant in many segments: ceramics require precise manufacturing, tight quality control, and high rejection rates; composites must face durability, delamination, and environmental aging; steels lose ground in weight-constrained use cases. Certification cycles are rigorous, and buyers hesitate to adopt new materials without fully validated ballistic performance.

Read More @ https://www.polarismarketresearch.com/industry-analysis/europe-armor-materials-market