South Africa Mobile Wallet Market Size, Share, Growth, and Forecast 2025-2033

Market Overview

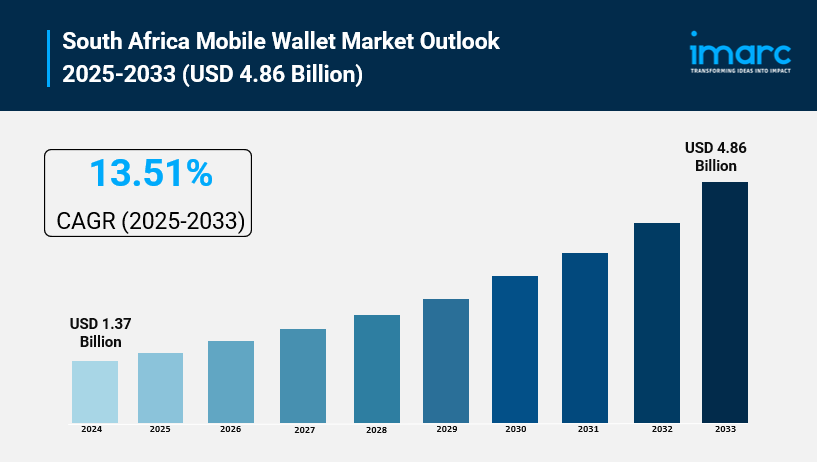

The South Africa mobile wallet market size stood at USD 1.37 Billion in 2024 and is projected to reach USD 4.86 Billion by 2033, growing at a CAGR of 13.51% during 2025-2033. The market growth is fueled by increased smartphone penetration, expanding internet connectivity, wider adoption of contactless payment methods, and an accelerated transition towards cashless transactions due to digital transformation in many sectors. Furthermore, artificial intelligence adoption is playing a significant role in boosting the market share. Learn more at South Africa Mobile Wallet Market.

How AI is Reshaping the Future of South Africa Mobile Wallet Market

- AI technologies enhance fraud detection measures, improving security in mobile wallet transactions and increasing user trust.

- Financial institutions and fintech firms utilize AI to personalize user experiences, streamlining payment processes and customer engagement.

- The integration of biometric authentication powered by AI strengthens security protocols to prevent unauthorized access.

- AI assists in refining customer insights through behavior research and predictive analytics, optimizing service offerings.

- AI-driven chatbots, like Absa Bank's ChatWallet launched via WhatsApp, support unbanked populations by enabling direct banking services.

- AI adoption contributes to the development of interoperable payment systems, facilitating cross-platform transactions for a seamless digital ecosystem.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-mobile-wallet-market/requestsample

Market Growth Factors

The South Africa mobile wallet market is witnessing major growth driven by rising digital payment adoption. Over 60% of South Africans favor digital wallets due to their convenience and seamless payment tracking, reducing reliance on physical wallets. The government's strong commitment to digital financial inclusion has resulted in a regulatory environment conducive to fintech innovations and mobile payment systems. Collaborative efforts between traditional banks, fintech firms, and mobile network operators have expanded integrated digital ecosystems, supporting banking, mobile money, and e-commerce solutions. This transformation extends financial access mainly to unbanked populations across both urban and rural areas, thereby fostering wider market acceptance and usage.

Infrastructure development alongside technology integration significantly propels market expansion. The growth and enhancement of 4G and 5G mobile network infrastructures improve transaction speed and security, enriching the user experience across mobile wallet platforms. It is projected that 5G subscriptions will surge, bolstering connectivity and seamless payment transactions. Mobile wallet providers employ advanced technologies such as AI and biometric authentication to strengthen fraud detection and security, while integration of NFC and QR-code based payment systems enhances versatility and usability at points of sale. The rise of super apps consolidates multiple financial services on one platform, establishing a comprehensive ecosystem catering to varied user needs including insurance, microfinance, and merchant transactions.

Small and medium-sized businesses benefit from the digitization of payments without requiring extensive infrastructure investments. This shift increases their customer base and improves cash flow management, enhancing operational efficiency. The digital transition empowers merchants with flexible and cost-effective payment solutions, accelerating market growth. Furthermore, the financial services sector's investment in developing interoperable payment technologies fosters ecosystem connectivity and supports the broader adoption of mobile wallet services, driving further market dynamism.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging South Africa mobile wallet market trends.

Market Segmentation

Type Insights:

- Proximity

- Remote

Application Insights:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Developement & News

- February 2025: Visa launched the ‘Tap to Add Card’ feature in South Africa, enabling cardholders to link bank cards to mobile wallets through NFC by simply tapping their cards on NFC-enabled phones. This innovation improves payment security and convenience, eliminating manual input errors and reducing fraud vulnerabilities.

- February 2024: Absa Bank introduced ChatWallet, a mobile wallet service via WhatsApp, aimed at financial inclusion by allowing unbanked individuals to perform banking activities directly through the messaging app, thereby enhancing access to basic financial services.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness