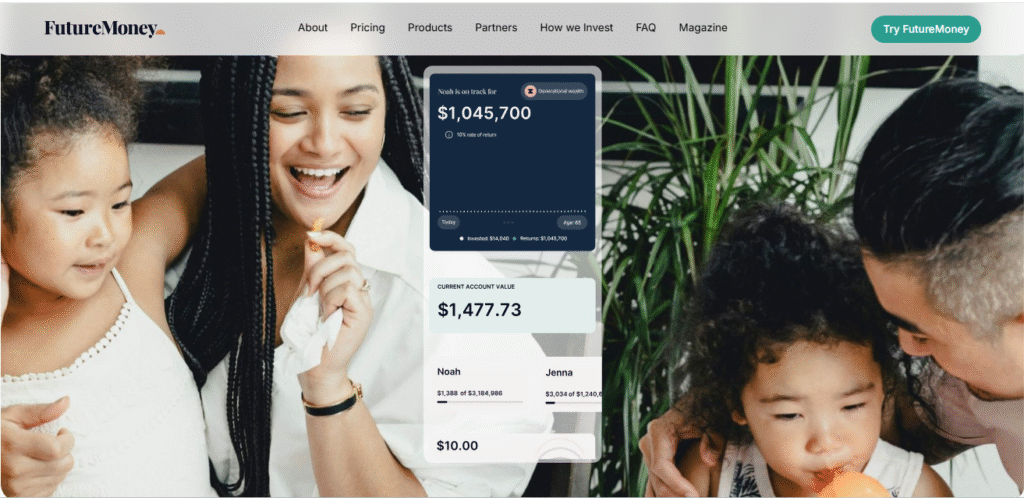

Grow, Protect, and Pass On Wealth with FutureMoney Investments

Wealth is not just about accumulation — it’s about growth, protection, and continuity. True financial success means creating resources that support your family today, safeguard them tomorrow, and empower future generations to thrive. That’s exactly what FutureMoney Investments is built to help you achieve.

FutureMoney offers a smarter, family-focused approach to financial planning, combining automation, education, and professional investment management. It empowers families to make consistent, informed decisions that grow wealth sustainably while ensuring that it’s passed down efficiently and responsibly.

1. Growing Wealth the Smart Way

FutureMoney simplifies the path to long-term financial growth with goal-based investing. Instead of managing scattered investments, families can organize their money around specific life goals — education, housing, retirement, or legacy building.

Each goal is backed by data-driven investment strategies that balance risk and return. Whether you’re just starting or already investing, FutureMoney ensures that every contribution works toward consistent, compounding growth.

The platform also encourages early investing, helping families take advantage of time — the most powerful tool in wealth creation. Even small investments, when made consistently, can grow exponentially through the power of compounding.

2. Protecting Family Wealth for the Future

Wealth without protection is vulnerable. Market fluctuations, inflation, and poor planning can easily erode what families have worked hard to build. FutureMoney focuses on protecting your investments through diversification and expert portfolio management.

Its algorithmic tools and professional advisors ensure that your money is spread across the right assets — such as equities, bonds, and ETFs — minimizing risk while maximizing returns.

Additionally, FutureMoney offers tax-efficient investment options, helping families retain more of their earnings. These strategies ensure that your financial plan remains resilient, no matter how the economy changes.

By prioritizing safety and smart allocation, FutureMoney helps your wealth withstand uncertainty and continue to grow steadily.

3. Passing On Wealth — The Generational Way

Creating wealth is only half the journey — passing it on effectively ensures your legacy endures. FutureMoney enables parents and grandparents to establish structured, long-term accounts for their children and heirs.

Families can set up investment goals for future generations, such as education, entrepreneurship, or inheritance funds. Over time, these investments compound, providing a strong foundation for children’s financial independence.

Moreover, by involving children in the investment process, parents teach them essential financial principles — budgeting, saving, and responsible investing — ensuring they not only inherit wealth but also the knowledge to manage it.

This combination of financial assets and education creates a true generational legacy — wealth that lasts and grows beyond one lifetime.

4. Automation That Makes Investing Effortless

The key to financial success isn’t timing the market — it’s consistency. FutureMoney’s automation tools make that possible for busy families.

You can set up recurring investments, automatic portfolio rebalancing, and reinvestment of returns. Once your plan is in motion, FutureMoney keeps it on track — ensuring every rupee continues to work toward your family’s goals.

This hands-free system removes emotional decision-making and helps families stay disciplined, even during market volatility. The result? Steady, predictable progress toward long-term wealth.

5. Transparency and Trust at Every Step

FutureMoney believes that financial confidence comes from clarity. The platform provides real-time insights, performance tracking, and easy-to-understand reports — ensuring you always know where your money stands.

With bank-grade encryption and privacy protection, your investments remain secure at all times. This transparency and reliability make FutureMoney a trusted partner for families seeking not just growth but peace of mind.

6. Empowering Families with Financial Education

Generational wealth doesn’t just require money — it requires financial literacy. FutureMoney encourages families to involve younger members in planning discussions, teaching them how investments work and why consistency matters.

These early lessons build strong financial habits, helping children understand the value of long-term thinking and smart decision-making. Through this education, FutureMoney transforms financial planning into a shared family experience, bridging generations with knowledge and confidence.

7. Why Families Choose FutureMoney

Families around the world are embracing FutureMoney for its simplicity, security, and shared purpose. It combines cutting-edge technology with family-centered values — helping you invest smarter, protect better, and pass down wealth with intention.

Whether you’re starting from scratch or refining your strategy, FutureMoney equips you with the right tools to achieve lasting financial success.

Final Thoughts

FutureMoney Investments redefines family wealth management. It’s not just about growing assets — it’s about protecting what you’ve earned and ensuring it benefits generations to come.

By blending smart technology, automation, and education, FutureMoney empowers families to take control of their financial futures — building legacies rooted in stability, wisdom, and opportunity.

Your wealth deserves to do more than grow — it deserves to last. Start with FutureMoney today, and create a financial legacy your family will cherish for generations.

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness