The Role of Business Credit Reports in Building Corporate Trust and Reputation

In today’s competitive business environment, trust and credibility are vital for sustainable growth. Companies, investors, and lenders rely on verified financial data to make informed decisions, and a Business Credit Report is one of the most important tools in this process. By providing a detailed overview of a company’s financial stability, repayment behavior, and creditworthiness, these reports play a critical role in establishing corporate trust and enhancing reputation in the market.

What Is a Business Credit Report?

A Business Credit Report is a comprehensive record of a company’s credit history and financial behavior. It includes:

-

Credit ratings and scores

-

Payment history with suppliers, lenders, and other creditors

-

Outstanding debts and liabilities

-

Financial statements, liquidity, and solvency analysis

-

Legal filings, defaults, or bankruptcy records

Unlike general business reports, a credit report focuses specifically on financial accountability. For lenders, investors, and potential partners, it serves as a key indicator of reliability and risk.

Why Business Credit Reports Build Trust

Trust is the foundation of all successful business relationships. When a company demonstrates strong financial discipline and a positive credit history, it signals reliability and stability. Business Credit Reports build trust by:

-

Providing Verified Financial Data

These reports offer factual insights into a company’s financial behavior, eliminating guesswork and assumptions. -

Demonstrating Repayment Reliability

Timely repayment of loans and obligations indicates fiscal responsibility, which reassures lenders, investors, and partners. -

Enhancing Transparency

Companies with accessible credit reports showcase openness, signaling a commitment to honesty and ethical business practices. -

Supporting Strategic Partnerships

Partners and suppliers are more likely to engage with companies that exhibit strong credit reliability, reducing the risk of defaults or financial disputes.

By using Business Credit Reports, companies can demonstrate credibility to all stakeholders, which is essential for long-term success.

The Connection Between Credit Reports and Reputation

A company’s reputation is shaped not only by its products or services but also by its financial reliability. A poor credit record can negatively impact relationships with clients, suppliers, and investors. Conversely, a strong credit history reflected in a Business Credit Report enhances a company’s reputation in several ways:

-

Investor Confidence: Investors prefer companies with stable credit histories, as they are less likely to default.

-

Supplier Assurance: Suppliers trust that payments will be made on time, fostering stronger B2B relationships.

-

Customer Trust: Clients perceive financially stable companies as reliable partners.

-

Market Positioning: A strong credit profile strengthens brand perception and positions the company as a trustworthy market player.

In essence, financial transparency and responsibility contribute significantly to corporate trust and overall reputation.

How Businesses Can Leverage Credit Reports

Companies can use Business Credit Reports proactively to improve their market image and strengthen stakeholder relationships:

-

Monitor Financial Health

Regularly reviewing your credit report helps identify areas for improvement and ensures long-term financial stability. -

Enhance Negotiation Power

A positive credit report can be leveraged to negotiate better terms with lenders, suppliers, and investors. -

Support Funding and Investment

Companies with strong credit histories are more likely to secure loans or attract investors. -

Build Stronger B2B Relationships

Demonstrating financial reliability fosters confidence among business partners, enhancing collaboration opportunities.

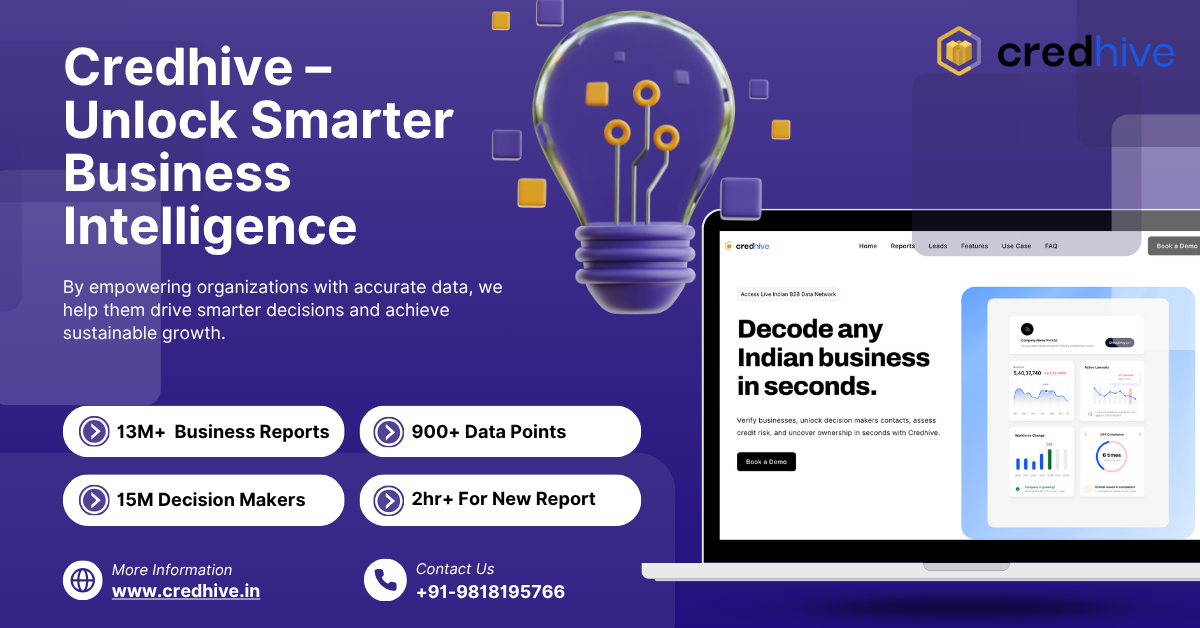

Platforms like Credhive provide access to accurate, verified Business Credit Reports, allowing companies to monitor their financial reputation and make data-driven decisions.

Integrating Credit Reports with Other Business Reports

While Business Credit Reports focus on financial credibility, their effectiveness increases when combined with:

-

Business Information Reports: Verify operational structure, company ownership, and business history.

-

Business Risk Reports: Identify potential operational, market, or compliance risks that could affect financial stability.

The combined insights give a 360-degree perspective on a company’s reliability, risk profile, and market standing, strengthening overall corporate trust.

Practical Applications in Building Corporate Trust

-

For Lenders: Assessing creditworthiness before extending loans to minimize default risk.

-

For Investors: Ensuring the company is financially sound before committing funds.

-

For Partners and Suppliers: Establishing reliable business collaborations based on verified financial data.

-

For Clients: Reinforcing confidence that contracts will be honored and projects delivered responsibly.

By consistently maintaining a strong credit profile, companies can position themselves as trustworthy and reputable in the business ecosystem.

The Role of Technology

Modern Business Intelligence Tools have revolutionized how businesses access Business Credit Reports. Platforms like Credhive allow companies to:

-

Retrieve verified financial data quickly and efficiently

-

Access real-time updates for accurate decision-making

-

Analyze credit reports alongside operational and risk data for comprehensive insights

Technology ensures that businesses can maintain transparency, track credit performance, and proactively enhance their reputation in the market.

Conclusion

A Business Credit Report is more than just a financial record—it is a strategic tool that builds trust, credibility, and reputation in the corporate world. By providing verified insights into financial behavior, repayment reliability, and creditworthiness, these reports help companies strengthen relationships with lenders, investors, suppliers, and clients.

Incorporating credit reports into business processes, particularly with platforms like Credhive, ensures access to accurate, actionable, and timely information. For businesses seeking long-term growth and strong market positioning, a robust credit profile is essential—not only for financial stability but also for fostering trust and credibility across the B2B ecosystem.

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness