Debt Syndication Service in India

What is Debt Syndication Service in India?

Debt syndication is a specialized financial service that enables businesses to raise substantial funds from multiple lenders such as banks, Non-Banking Financial Companies (NBFCs), and other financial institutions. It is particularly useful for companies seeking capital for expansion, working capital requirements, acquisitions, infrastructure projects, or refinancing existing debt.

In today’s competitive environment, accessing large-scale funding through a single lender can be challenging. Debt syndication provides an effective solution by pooling funds from several institutions under a structured arrangement, reducing financial risk and ensuring better terms for borrowers.

How Debt Syndication Works

Debt syndication operates through a financial advisor or consultant who acts as a bridge between the borrower and potential lenders. The process typically unfolds through the following stages:

-

Assessment of Financial Needs – The consultant evaluates the company’s funding requirement, project feasibility, and repayment capability.

-

Structuring the Proposal – Based on the analysis, a suitable financial structure is created—this could include term loans, working capital limits, or project finance models—to align with the company’s cash flows and risk profile.

-

Identification of Lenders – The advisor approaches banks, NBFCs, and institutional investors most likely to participate in the loan syndication.

-

Negotiation & Documentation – Key elements such as interest rates, repayment schedules, covenants, and security terms are negotiated and finalized.

-

Disbursement of Funds – Once all parties agree, funds are syndicated and disbursed from multiple lenders, ensuring that the borrower receives the total financing required.

Types of Debt Syndication Services in India

Debt syndication can take several forms depending on the specific needs of the business:

-

Term Loan Syndication – Long-term financing for capital investment, plant setup, or expansion projects.

-

Working Capital Syndication – Short-term funds to manage daily operations and maintain liquidity.

-

External Commercial Borrowings (ECB) – Raising debt from international lenders at competitive interest rates.

-

Structured Finance – Customized solutions for complex or high-value projects.

-

Refinancing Services – Replacing existing loans with new debt under better terms and lower costs.

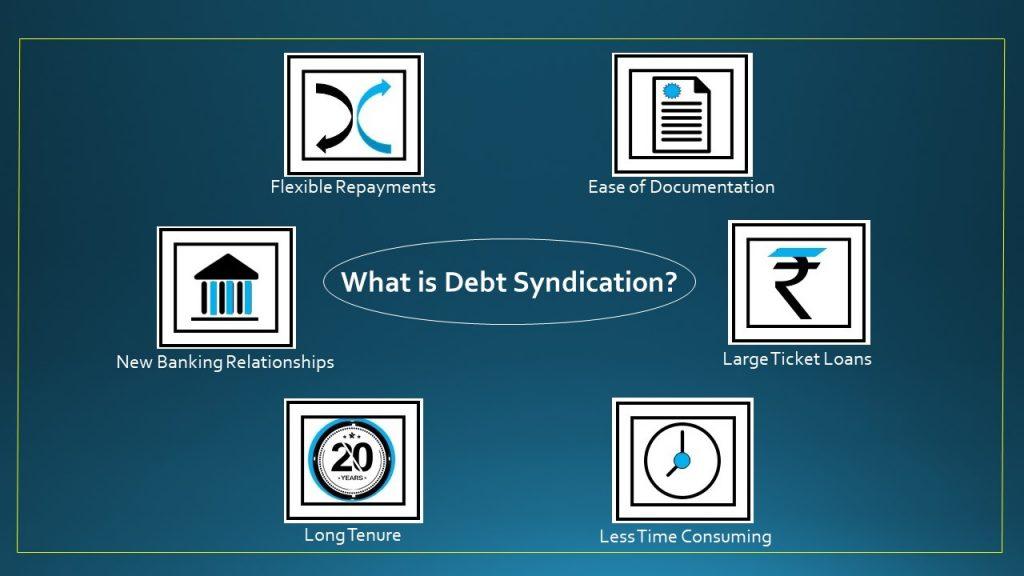

Key Benefits of Debt Syndication

✅ Access to Large Capital: Enables companies to raise significant funds beyond the limits of a single lender.

✅ Optimized Cost of Funds: Multiple lenders and competition often lead to better interest rates.

✅ Flexible Repayment Options: Loans can be structured to suit the company’s financial position.

✅ Diversified Risk: Reduces dependence on one financial institution.

✅ Expert Guidance: Advisors handle negotiations, documentation, and compliance efficiently.

Who Provides Debt Syndication Services in India?

Debt syndication services are offered by financial advisory firms, investment banks, chartered accountants, and NBFCs with advisory divisions. Prominent players in India’s syndication space include SBI Capital Markets, Axis Bank, Yes Bank, Edelweiss, and several boutique advisory firms catering to mid-sized and sector-specific businesses.

Leading Advisors for Debt Syndication in India

India boasts a strong network of financial consultants specializing in debt syndication. One leading platform is NPAHELP, a financial advisory firm offering services such as debt syndication, loan restructuring, NPA resolution, and financial consulting.

NPAHELP assists companies in:

-

Arranging term loans and working capital from multiple lenders

-

Structuring and negotiating favorable loan terms

-

Managing stressed assets or NPA-related cases

-

Providing expert guidance in project and business finance

With a team experienced in banking and financial restructuring, NPAHELP helps businesses secure the right funding solutions and maintain strong financial health.

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness