Unlocking Value in the Artificial Intelligence (AI) Insurtech Market: Opportunities, Risks & Forecast

Introduction

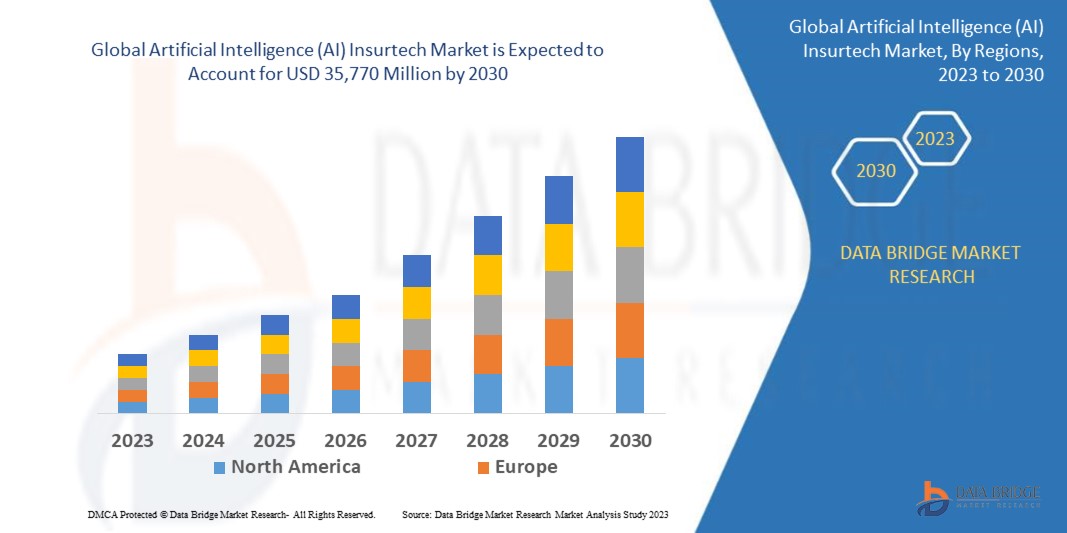

The Artificial Intelligence (AI) Insurtech Market is undergoing rapid expansion, driven by insurance companies’ increasing need for efficiency, precision, and digital transformation. In 2022, the market was valued at approximately USD 3,640 million, and projections indicate a surge to USD 35,770 million by 2030, demonstrating a robust CAGR of 33.06% during the forecast period of 2023–2030.

AI-powered insurtech is reshaping how insurers underwrite risk, handle claims, and engage customers. From automating underwriting to detecting fraud, the technology is becoming central to business models in life, health, auto, and other insurance lines. As competition mounts and regulation tightens, participating in the AI Insurtech market is less optional and more foundational for long-term viability.

Market Overview

Insurance traditionally has been a data-intensive but manual and slow-paced industry, especially in functions like underwriting, claims adjudication, and risk assessment. AI is changing that by bringing automation, predictive analytics, natural language processing, and machine vision into core operations for insurers. The uptake of cloud‐based models and improvements in data availability (from IoT, telematics, etc.) are helping facilitate this transformation.

The Global Artificial Intelligence (AI) Insurtech Market is not just about cost savings; it is evolving toward delivering better customer experience, faster response times, more accurate risk models, and deeper regulatory compliance. Entities using AI for fraud detection, claims management, risk modelling, and chatbots are seeing disproportionate gains.

Geographically, North America currently dominates the AI insurtech market, owing to early adopter insurers, strong regulatory frameworks, and large investments in AI capabilities. Meanwhile, Asia-Pacific is positioned as one of the fastest growing regions due to increasing digital penetration, supportive government policies, and rising insurance awareness.

Key Growth Drivers

The rapid rise of the Global AI Insurtech Market is being propelled by several interrelated forces:

Automation of Insurance Processes: AI allows for automated underwriting, claims processing, and risk evaluation, which reduces turnaround times and operational costs dramatically.

Data Abundance & Analytics: The rise of telematics, IoT, wearable devices, and other data sources provide richer inputs for AI models, enabling improved risk prediction and personalized policies.

Fraud Detection and Risk Management: With fraudulent claims being a major cost drain, AI’s ability to detect anomalous patterns in real time offers insurers a compelling value proposition.

Customer Experience & Chatbots: AI-driven conversational agents and recommendation systems improve customer engagement. Insurers are using chatbots for customer service, policy renewals, and even initial claim submissions.

Regulatory Pressure & Compliance: As regulatory frameworks strengthen (e.g. around data privacy, claims transparency), insurers are investing in AI tools that can ensure compliance while maintaining efficiency.

Insurtech Innovation & Ecosystems: Partnerships, acquisitions, and startups are accelerating development of niche AI solutions tailored for insurance sub-sectors (e.g. life, auto, health).

Market Segmentation

Market Segmentation

To understand where value is concentrated in the AI Insurtech Market, here are the key segmentation dimensions:

| Segment | Sub-segments / Details |

| Component | Hardware, Software, Services Data Bridge Market Research |

| Technology | Machine Learning & Deep Learning; Natural Language Processing; Machine Vision; Robotic Automation |

| Deployment Model | On-Premises vs Cloud |

| Enterprise Size | Large Enterprises vs SMEs (Small & Medium Enterprises) |

| Application | Claims Management; Risk Management & Compliance; Chatbots; Others (including customer profiling, underwriting) |

| Sector | Life Insurance; Health Insurance; Auto Insurance; Title Insurance; Others |

Each segment has unique dynamics. For example, the software component is capturing large revenue shares due to scalable deployment, while hardware is essential for data processing, inference, and maintaining secure infrastructure. Cloud deployment is gaining traction especially among SMEs for lower upfront costs.

Regional Insights

North America leads in adoption of AI in insurtech, with the U.S. being home to many of the major players, robust regulatory frameworks, and high customer expectations for digital services.

Europe follows, especially in regulations (GDPR etc.), and healthcare & life insurance sectors where AI applications are increasingly being integrated for compliance and risk modelling.

Asia-Pacific is anticipated to be among the fastest growing regions thanks to digital infrastructure investments, insurance penetration growth, and favorable government policies in countries like India, China, and Southeast Asian markets.

Middle East, Africa, Latin America are emerging markets; challenges include data infrastructure, regulatory uncertainty, and cost constraints, but the potential for growth is high as insurers in these regions seek digital transformation.

Competitive Landscape

The Global AI Insurtech Market features competitive pressures from both established incumbents and agile startups. Key players include:

Microsoft (U.S.) – offering AI platforms, cloud services, and analytics tools.

Infosys Limited (India) – strong in integration, consulting and developing AI & machine learning solutions for insurers.

Tractable Ltd – focused on claims processing via computer vision and machine learning.

Insurify, Slice Insurance Technologies Inc., Google, Oracle, Amazon Web Services, IBM – various strengths across software, cloud, AI tools.

Regional/newer players – smaller startups in Asia and other markets are specializing in niche applications (e.g. fraud detection, chatbots, risk scoring) and are often more agile.

Competitive strategies include:

Investing in R&D to improve accuracy and reduce bias in AI models.

Strategic partnerships between tech firms and insurers.

Mergers & acquisitions to add capabilities or enter new geographic markets.

Emphasis on transparency, fairness, and explainable AI to comply with regulation and gain trust.

Market Trends and Opportunities

Some of the emerging trends and opportunities in the Global AI Insurtech Market include:

Explainable AI & Trustworthy Models: As regulatory and customer scrutiny increases, insurers and tech providers are adapting AI tools that are interpretable, auditable and explain fairness.

Embedded Insurance & Usage-Based Models: With IoT and telematics, usage-based, on-demand, or embedded insurance models are gaining ground, e.g. for auto insurance, health wearables.

AI in Claims Adjudication & Automation: End-to-end automation of claims process, including auto-assessment using image & document processing.

Fraud Detection Enhancements: Sophisticated AI tools to detect anomalous behavior, deepfakes, false documentation, etc.

Expansion in Emerging Markets: Many insurers in emerging economies are under-insured; AI can help reduce underwriting cost and risk which makes coverage more accessible.

Regulatory & Ethical Frameworks: Opportunities for vendors who build AI solutions that are compliant with evolving insurance and data privacy regulation.

Challenges and Restraints

Despite strong prospects, there are several barriers:

Data Privacy & Regulatory Hurdles: Insurers need to navigate strict privacy laws, cross-border data transfer rules, and regulations around AI-driven decision making.

Bias, Explainability & Trust: AI models may suffer from bias if trained on non-representative data; lack of explainability can undermine trust.

High Initial Costs & Integration Complexity: Upfront investment in hardware, software, cloud infrastructure, training, etc., can be prohibitive especially for smaller insurers.

Skill Gaps: Lack of qualified AI, ML specialists in many regions; implementing complex AI systems requires domain knowledge plus technical expertise.

Legacy Systems: Many insurance firms run on legacy infrastructure; integrating AI solutions into old systems can be difficult, slow, and costly.

Future Outlook

Looking ahead, the Global AI Insurtech Market is expected to maintain double-digit growth through at least 2030. Key factors shaping the future include:

Larger investments into AI infrastructure, especially cloud, edge computing, and secure data pipelines.

Increasing adoption of hybrid models combining human oversight plus AI automation to balance efficiency with trust and compliance.

Greater regulatory interest: governments and international bodies will likely issue more guidelines around AI fairness, transparency, data governance.

Increased uptake in life, health, and microinsurance lines, particularly in developing countries.

More integration with other emerging technologies such as blockchain, IoT, and edge AI for real-time risk monitoring and dynamic pricing.

Conclusion

The Global Artificial Intelligence (AI) Insurtech Market is poised for a period of significant transformation and growth. From USD 3.64 billion in 2022 to a projected USD 35.77 billion by 2030 at a CAGR of approximately 33.06%, the market’s future is promising. Insurers, technology providers, startups, and investors who can leverage AI in risk management, claims automation, fraud detection, customer experience, and regulatory compliance are likely to capture meaningful value.

While challenges like regulatory compliance, data privacy, initial investment, and skill gaps remain, the opportunities in emergent applications, underserved geographies, and hybrid human-AI models offer strong upside. For stakeholders in the insurance ecosystem, aligning business strategies with technological innovation, ethical AI practices, and regulatory readiness will be essential to succeed.

FAQs

What is the current value of the Global Artificial Intelligence (AI) Insurtech Market?

At what CAGR is the Global Artificial Intelligence (AI) Insurtech Market expected to grow from 2023 to 2030?

Who are the major players in the Global Artificial Intelligence (AI) Insurtech Market?

Which region is likely to witness the fastest growth in the Global AI Insurtech Market?

What are the biggest challenges for adoption of AI in insurtech?

Get strategic knowledge, trends, and forecasts with our Artificial Intelligence (AI) Insurtech Market report. Full report available for download:

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

Browse More Reports:

Global Underwater Robotics Market

Global Denosumab Market

Global Dimethyl Ether Market

Global Electric Vehicle Market

Global eSports Market

Global Fat Powder Market

Global Luxury Jewellery Market

Global Surfing Boards Market

Europe Rolling Stock Market

Middle East and Africa Rolling Stock Market

Middle East and Africa Wood Pellet Market

Global Baby Feeding Bottle Market

Global Betanin Market

Global Busbar Market

Global Digital Health Monitoring Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Artificial Intelligence (AI) Insurtech Market Size, Artificial Intelligence (AI) Insurtech Market Share, Artificial Intelligence (AI) Insurtech Market Trends, Artificial Intelligence (AI) Insurtech Market Growth , Artificial Intelligence (AI) Insurtech Market Competitive Outlook

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness