Platform Based Master Card Market Growth Outlook & Forecast

"Key Drivers Impacting Executive Summary Platform Based Master Card Market Size and Share

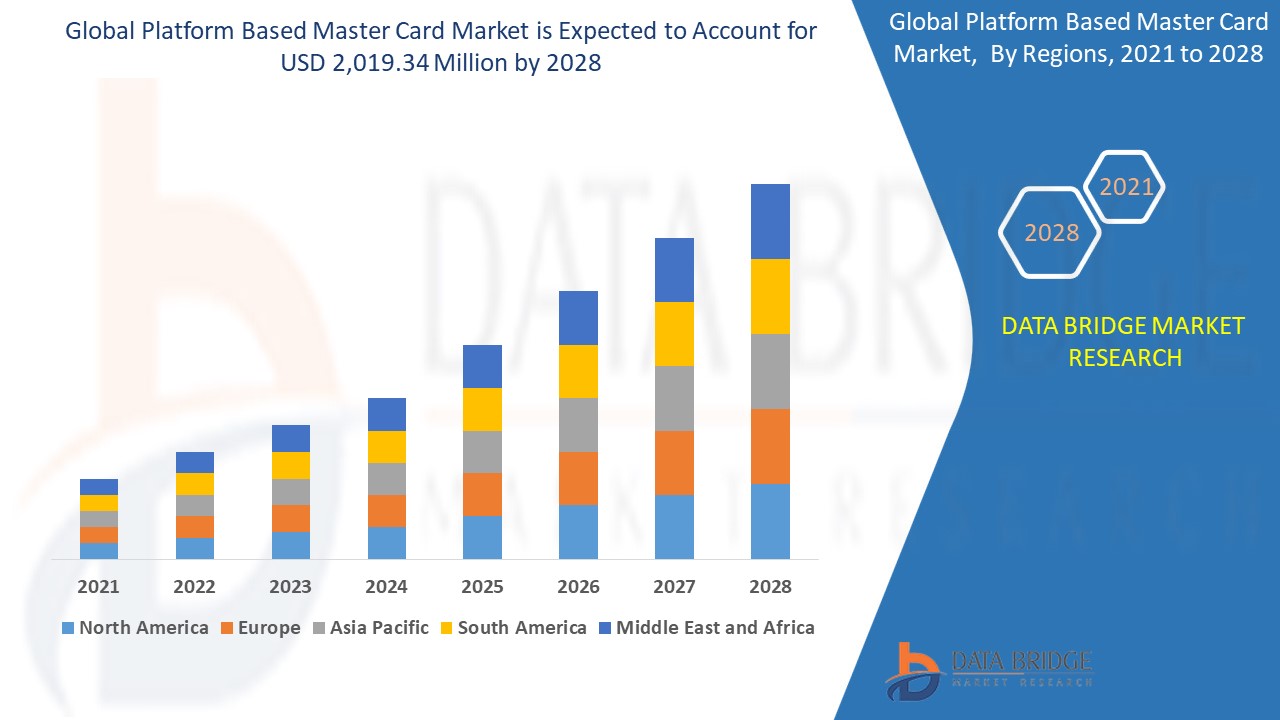

The global platform based master card market size was valued at USD 1.30 billion in 2024 and is projected to reach USD 3.12 billion by 2032, with a CAGR of 11.50% during the forecast period of 2025 to 2032.

Business intelligence has been employed here to create Platform Based Master Card Market report which is a vital aspect when it comes to accomplish thorough and wide-ranging market insights. Many businesses have started adopting a market research report solution. This market research report endows clients with the supreme level of market data which exactly suits to the niche and business requirements. The business report has been prepared specifically by keeping in mind business needs of all sizes. An excellent Platform Based Master Card Market report is a definitive solution for sound decision making and superior management of goods and services.

The company profiles of all the top market players and brands are listed in Platform Based Master Card Market report which puts light on their moves like product launches, product enhancements, joint ventures, mergers and acquisitions and their effect on the sales, import, export, revenue and CAGR values. This credible report includes key information about the industry, market segmentation, important facts and figures, expert opinions, and the latest developments across the globe. According to this market report, the global market is anticipated to witness a moderately higher growth rate during the forecast period. Moreover, businesses can accomplish insights for profitable growth and sustainability programme with Platform Based Master Card Market report.

Understand market developments, risks, and growth potential in our Platform Based Master Card Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/global-platform-based-master-card-market

Platform Based Master Card Industry Trends

**Segments**

- **By Service Type**: The platform-based Master Card market can be segmented by service type into banking services, payment processing services, and others. Banking services include online banking, mobile banking, and ATM services. Payment processing services encompass online payments, in-store transactions, and peer-to-peer transfers. The 'others' category may include loyalty programs, fraud detection services, and credit monitoring services.

- **By End-User**: The market can also be segmented by end-user, with categories such as individual consumers, small and medium enterprises (SMEs), and large enterprises. Individual consumers utilize Master Card services for personal banking transactions and online purchases, while SMEs and large enterprises may require specific payment processing solutions for their businesses.

- **By Region**: Geographically, the platform-based Master Card market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Each region has its own set of market dynamics, regulatory frameworks, and consumer preferences that impact the adoption and growth of Master Card services.

**Market Players**

- **Mastercard Incorporated**: As a global leader in payment technology and services, Mastercard offers a wide range of platform-based solutions for consumers, businesses, and financial institutions. The company's innovative products and strategic partnerships have positioned it as a key player in the industry.

- **Visa Inc.**: Visa is another major player in the platform-based Master Card market, providing secure and convenient payment solutions for individuals and businesses worldwide. The company's extensive network and focus on digital payments have earned it a strong presence in the market.

- **American Express Company**: With a reputation for premium financial services and customer loyalty programs, American Express is a significant player in the platform-based Master Card market. The company's focus on affluent consumers and corporate clients sets it apart in the competitive landscape.

- **PayPal Holdings, Inc.**: As a leading digital payment platform, PayPal offers a range of Master Card-based services for online transactions and money transfers. The company's user-friendly interface and widespread acceptance make it a popular choice among consumers and merchants.

- **Square, Inc.**: Square is known for its innovative approach to payment processing, offering Master Card solutions for small businesses and independent sellers. The company's emphasis on mobile payments and point-of-sale systems has helped it gain traction in the market.

The global platform-based Master Card market is a dynamic and competitive landscape, with key players vying for market share through innovation, strategic partnerships, and enhanced services. As digital payment solutions continue to evolve, consumers and businesses alike will benefit from the convenience and security of Master Card services.

The platform-based Master Card market is witnessing significant growth and innovation, driven by technological advancements, changing consumer behavior, and the increasing digitization of financial services. One key trend that is shaping the market is the rise of contactless payments, which have gained popularity due to their convenience and enhanced security features. Mastercard and other major players in the industry are investing heavily in contactless payment technologies to meet the growing demand for fast and secure transactions.

Another important trend in the platform-based Master Card market is the increasing focus on personalization and customization of services. Companies like Mastercard are leveraging data analytics and artificial intelligence to offer tailored solutions to individual consumers and businesses, enhancing the overall user experience and loyalty. By understanding customer preferences and behavior, Mastercard can provide targeted services that meet specific needs and drive engagement.

Moreover, the platform-based Master Card market is witnessing a proliferation of mobile payment solutions, with consumers increasingly opting for digital wallets and mobile apps to make transactions. This shift towards mobile payments is reshaping the payments landscape and driving innovation in areas such as peer-to-peer transfers, in-app purchases, and contactless payments. Mastercard and its competitors are actively developing mobile payment solutions to cater to this trend and provide seamless and secure payment experiences on smartphones and other mobile devices.

Furthermore, the platform-based Master Card market is experiencing increased regulatory scrutiny and compliance requirements, as governments and regulatory bodies seek to enhance security and data protection in the financial services industry. Companies like Mastercard are investing in cybersecurity measures, data encryption technologies, and fraud detection systems to ensure the safety of transactions and protect sensitive customer information. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) is essential for maintaining trust and credibility in the market.

In conclusion, the platform-based Master Card market is evolving rapidly, driven by technological innovation, changing consumer preferences, and regulatory developments. Companies like Mastercard are at the forefront of these changes, leveraging their expertise and resources to provide secure, convenient, and personalized payment solutions to a wide range of end-users. As the market continues to grow and adapt to new challenges and opportunities, collaboration, innovation, and a customer-centric approach will be key to success in the dynamic and competitive landscape of platform-based Master Card services.The platform-based Master Card market is witnessing significant growth and evolution driven by various factors shaping the industry landscape. One of the key trends impacting the market is the increasing adoption of contactless payments, driven by the demand for convenient and secure transaction methods. This trend is reshaping consumer behaviors and preferences, with Mastercard and other market players investing heavily in contactless payment technologies to meet the rising consumer expectations for fast and secure payment options.

Moreover, personalization and customization of services have become pivotal in the platform-based Master Card market. Companies like Mastercard are leveraging advanced technologies such as data analytics and artificial intelligence to tailor services to individual consumer and business needs. By offering personalized solutions, Mastercard can enhance user experience, drive customer loyalty, and meet the ever-evolving demands of the market.

Additionally, the proliferation of mobile payment solutions is revolutionizing the payment landscape, with a growing number of consumers opting for digital wallets and mobile apps for their transactions. This shift towards mobile payments is driving innovation in the industry, particularly in areas like peer-to-peer transfers, in-app purchases, and contactless payments. Mastercard and its competitors are actively developing mobile payment solutions to cater to this trend, providing seamless and secure payment experiences on mobile devices.

Furthermore, regulatory scrutiny and compliance requirements are shaping the platform-based Master Card market, with a strong focus on enhancing security and data protection in financial services. Companies like Mastercard are investing in robust cybersecurity measures, data encryption technologies, and fraud detection systems to ensure transaction safety and protect customer information. Compliance with regulations such as GDPR and PCI DSS is critical for building trust and credibility in the market, highlighting the importance of maintaining high-security standards.

In conclusion, the platform-based Master Card market is characterized by rapid evolution, technological innovation, changing consumer preferences, and regulatory developments. Key players like Mastercard continue to drive the industry forward by offering secure, convenient, and personalized payment solutions that cater to the diverse needs of consumers and businesses. Collaboration, innovation, and a strong customer-centric approach will be essential for success in this dynamic and competitive market landscape as companies navigate new opportunities and challenges in the ever-evolving world of platform-based Master Card services.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/global-platform-based-master-card-market/companies

Platform Based Master Card Market Reporting Toolkit: Custom Question Bunches

- What is the latest valuation of the Platform Based Master Card Market?

- What is the CAGR across different segments?

- What are the most lucrative applications in the Platform Based Master Card Market?

- Who are the key stakeholders across the supply chain?

- What recent developments have changed the Platform Based Master Card Market structure?

- What countries are critical from a Platform Based Master Card Market share perspective?

- What is the most rapidly evolving geographic segment?

- Which countries are introducing Platform Based Master Card Market friendly regulations?

- What regions are currently undervalued?

- What market limitations are being addressed through innovation?

Browse More Reports:

Global Pizza Box Market

Europe Sunflower Seeds Market

Global Coffee Creamer Market

Global Frozen Bakery Additives Market

Asia-Pacific Electric Vehicle Thermal Management System Market

North America Panel Mount Industrial Display Market

Global Induction Cookware Market

Global Paresthesia Market

Global Sleeping Medications Market

Middle East and Africa Polyglycerol Esters Market

Global Meat Testing Market

Global Marine Internet of Things Market

Global Nanopore Sequencing Market

Global Farm Product Warehousing and Storage Market

Global Practice Management Systems Market

Europe Terminal Management System (TMS) Market

Asia-Pacific Industrial Hoses Market

Malaysia Automotive Interior Materials Market

Global E-Line Metro Ethernet Services Market

Global Organic Solar Cell (OPV) Market

Global Tulip Market

Global Customized Baking Mixes Market

Global Post-Traumatic Stress Disorder (PTSD) Market

Europe Wearable Electronic Devices Market

U.S. Abrasives Market – Industry Trends and Forecast to 2031

Global Translucent Concrete Market

North America Medical Device Reprocessing Market

Global Pars Planitis Treatment Market

Global Terrestrial Television Equipment Market

Global Vegan Butter Market

Global Aerospace and Defense Elastomers Market

Global Automatic Emergency Braking Market

Global AI-Optimized Bioprocessing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- AI

- Vitamins

- Health

- Admin/office jobs

- News

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness